And We're Back: Looking Ahead to 2023

Wise money management grows wealth in all economic conditions.

Three-and-a-half years ago I was essentially broke. I was between jobs, and the only things of any monetary value that I could claim were shares of two Vanguard mutual funds from my first job after college.

I had no money in my savings account, and the funds in my checking account were so low that I was fined by my bank. Financially, I had hit rock bottom.

Looking back, I love telling this story (alongside every other financial influencer on the internet). The life events that led me to this point are less important than the decisions and practices that have allowed me to rebuild my finances.

That’s why I’m excited to get back to writing Evan Invests after taking the past month off from writing. The financial wins I’ve seen in my life — rebuilding my checking and savings accounts — and the wins I’m beginning to see with investing can become wins shared by those who read my posts.

You don’t have to be rich to be good with money. I’m sure not. And I can promise you that as I continue to do basic things correctly, my wealth will continue to grow.

So that’s what you count on from me this year: Weekly posts about what I have done, am doing, are am considering to grow wealth with my own finances and investment portfolio.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in cryptocurrency, index funds, stocks and more.

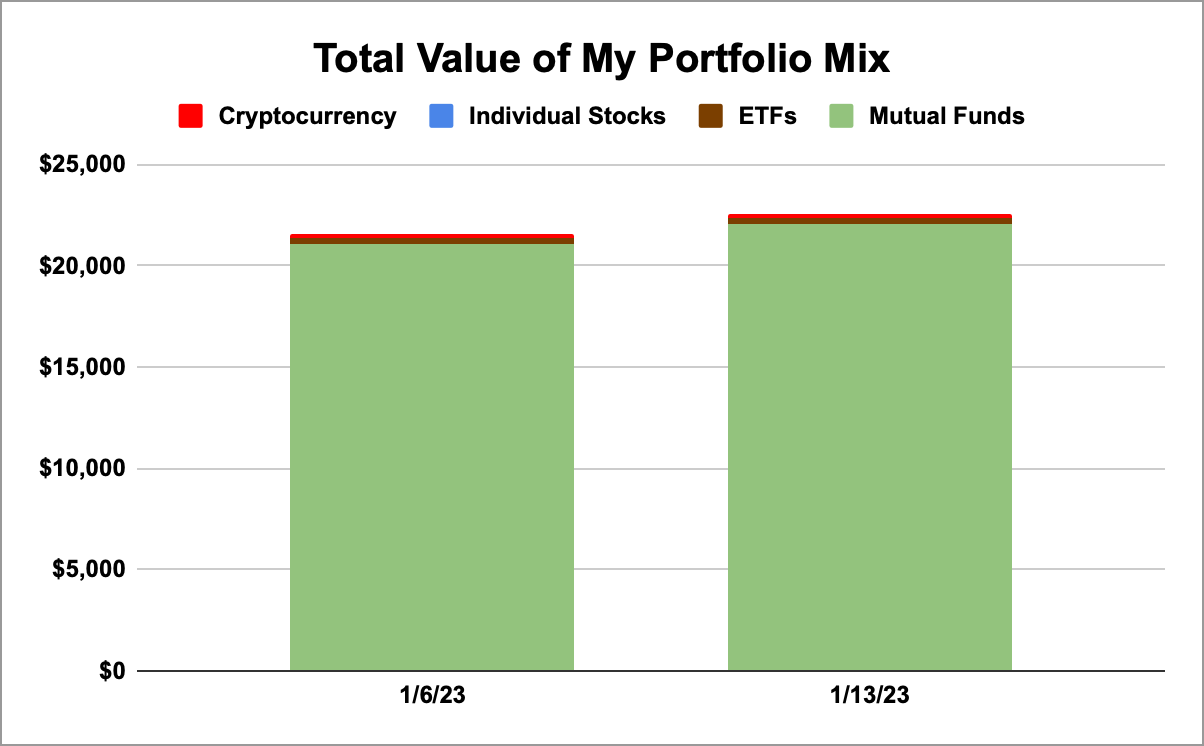

Before looking ahead to some financial and investing topics I’m excited about right now, let’s take a quick look at how my portfolio has been performing.

My Portfolio Holdings as of 1/13/23

Apple stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

I’m trying to temper my excitement about any investment at the moment as I continue to have a weird feeling that something is waiting to break in the economy (just my *opinion*). That said, I’m not going to complain about how my mutual funds have been doing.

Also, as of the publishing of this post, Bitcoin is back above $20,000. I guess Bitcoin isn’t dead following the collapse of FTX. Long live BTC.

Over the next few weeks I’m thinking about taking another look at my Bitcoin holdings, and how I’m protecting myself from the collapse of another exchange like FTX. I’m also thinking about looking into high-yield savings account to fight back against inflation eating into my savings account.

I’m also probably going to take a look at Robinhood’s tax advantaged investing options as well as retool my budget for the new year.

Evan Invests is back, and there are a lot of exciting posts coming soon. I can’t wait to share them with you all.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

💰 I help people finance homes for a living. If you’re looking to buy or refinance, use my link to get a sweet mortgage discount from Rocket Mortgage.

📈 Inspired to begin investing yourself? Use my link to open an account on Robinhood, and we’ll both get between $5 and $200 toward a stock.

I'm glad it's back in action!