Budgeting and portfolio growth. Yes - the two go together.

My investing journey has only been possible because of hard decisions I've made about how I spend my money.

A few years back, my dad laid out a helpful picture for thinking about cash flow that has stuck with me ever since. A bathtub. The water coming out of the faucet is my income stream. The tub is my bank account. The drain is my spending.

I can raise the water level in my bathtub in one of two ways, my dad explained. I can either increase the amount of water rushing in through the faucet, or I can plug the drain at the bottom. Both will result in the level of water in the tub going up, but one is easier than the other.

Wanna guess which one it is?

As someone whose had a find new work twice in my relatively brief five-year career, I can say from experience that increasing income is much more difficult than cutting down on spending.

The reason for this is simple — increasing my income involves other people, while (barring an unforeseen emergency) spending less money involves only myself.

I count myself blessed to have had budgeting introduced to me during my senior year of college before I was earning any substantial amount of money. And I speak from experience when I say that budgeting has allowed me to save for retirement and stay debt-free through periods of my adult life where I scraped-by as a freelance writer, or for a brief period of time when I was between jobs.

Budgeting works.

So when I saw the following tweet from Graham Stephan, an investing influencer I follow on social media, I knew what this week’s post would be about.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in crypto-currency, index funds, stocks and more.

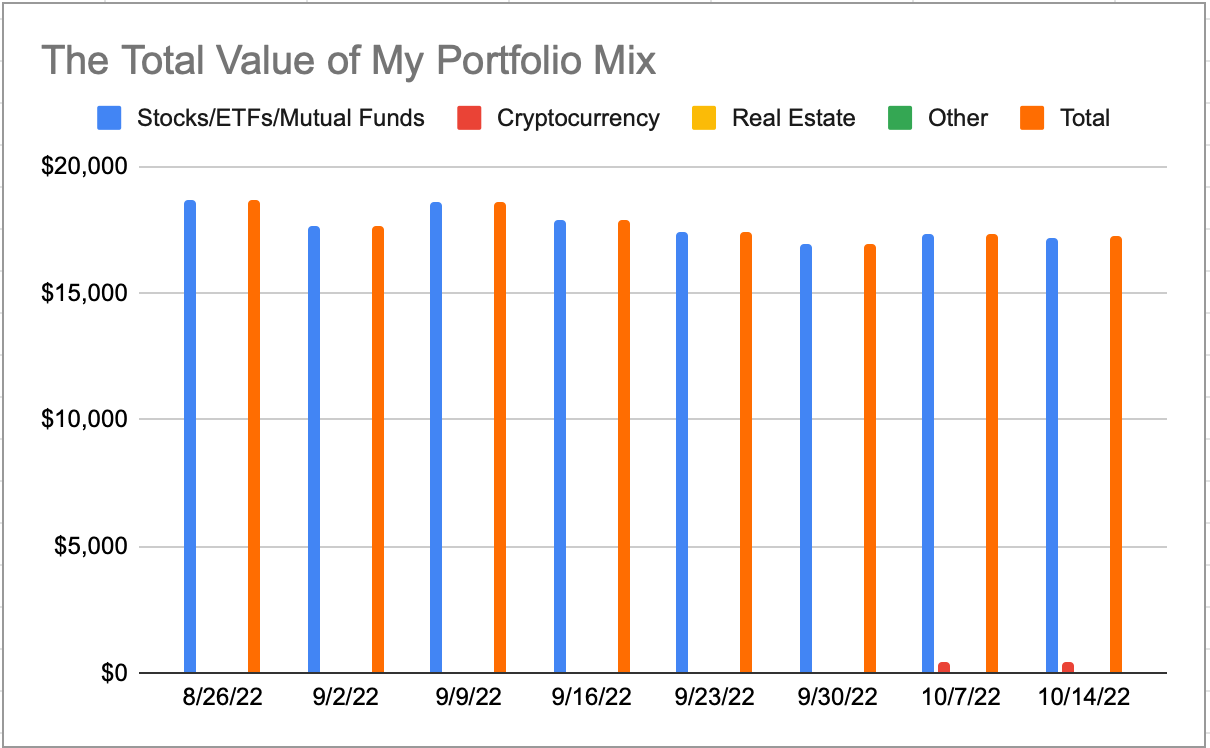

Before talking about budgeting, let’s take a quick look at how my portfolio has been performing.

My Portfolio Holdings as of 10/14/22

Apple stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

Like two weeks ago, the value of my portfolio changed little this past week. Which, with all the news about record inflation, falling wages and another rate hike from the U.S. Federal Reserve being likely, was a result I was actually pretty happy about. (For those wondering what it means when the fed raises rates, here’s a link I found helpful.)

And in the face of these challenging market conditions, I’m making plans to increase my investing, and do so for the foreseeable future.

I’m able to do this because I spend less than I make. And a budget is the tool I use to track expenses and make a plan for where my money will go.

If you don’t have a budget, make one.

I made this plug in my post on October 3rd, and I’m going to do it again here. I use YNAB to help me budget and there are several great options available, some free and others costing money.

My income hasn’t increased since I started this newsletter, but my investing has. In the past three months I’ve gone from investing $0 on top of my employer retirement plan, to next month planning to invest $100 over my my employer retirement plan.

The amount of monthly savings I’m directing toward the down payment on a house has quadrupled.

I’m able to do this because I know how much money I have coming in and I know where the money needs to be spent or saved. And because I have easy access to my budget, it has been relatively easy for me to cut things that I no longer need to spend money on, and shift my savings priorities to better fit my current season of life.

Budgeting works.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

Speaking my language with this week's post!