Choosing my first dividend stock: DINO.

I've always wanted to buy energy stocks. I'm finally doing it with HF Sinclair.

While this may be counter-cultural to say at the present time, I am a big believer in oil and gas companies. When thinking about which industry in which to explore building my dividend stock portfolio, I knew from the beginning I wanted to look at energy stocks.

When people think of Detroit, Michigan, where I’m from, they think about automotive companies. Chrysler. Ford. GM. We put the world on wheels.

And right now the automative industry is putting a lot of its focus on building the battery-powered, electric vehicle portion of its businesses, while scaling back the gasoline-powered vehicle portion of its businesses.

Fair enough. But the world still runs on combustable fuels like oil and gas, and will continue to do so for a long time.

I initially looked at buying stock in ExxonMobil, which is known for being a reliable stock for dividend growth. In fact, some investors call it a “Dividend Aristocrat” due to its consistency in increasing dividend payments over the last 25 years.

But after reading this article in yahoo! finance, I was intrigued by Dallas, Texas-based energy company HF Sinclair. And after learning that its earnings grew by more than 400 percent over the past year and its stock price is considered to be undervalued, I had to take a further look.

Here’s what I found out about HF Sinclair/DINO using the dividend stock evaluating framework from The Single Best Investment by Lowell Miller.

High Quality. The company has enough assets to coverage its debts. And it has enough assets to cover its dividend payments. A downside to this stock is that its revenue and earnings are expected to go down over the next few years.

High Current Dividend Yield. The company has a dividend yield of 3.9 percent. The industry average for March 2023 is 1.7 percent. And, it paid out 8 percent of its profits in dividends last year.

High Growth Dividend Yield. Despite analysts predicting that profits will decrease in the next few years, analysts are predicting that the dividend yield will increase. This is exciting news, and something I’m looking for when it comes to picking a stock.

I’m convinced. I’ve set-up a recurring investment of DINO on my Robinhood app.

I’m excited to see how this plays out.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I look to grow my wealth through wise money management and making investments in cryptocurrency, index funds, stocks and more.

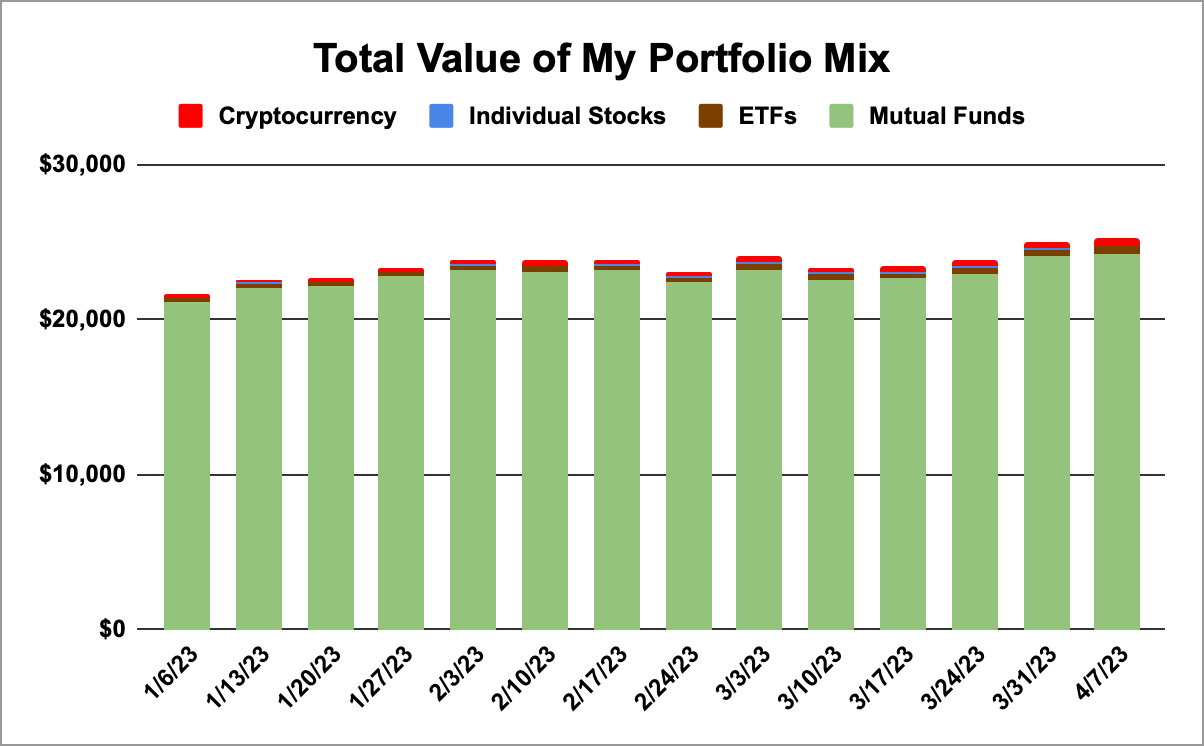

Let’s take a quick look at how my portfolio has been performing in the past week.

YTD invested (total): $1,920.87

YTD Growth: 8%

My Portfolio Holdings as of 4/7/23

Apple stock

Rocket Companies stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

💰 I help people finance homes for a living. If you’re looking to buy or refinance, use my link to get a sweet mortgage discount from Rocket Mortgage.

📈 Inspired to begin investing yourself? Use my link to open an account on Robinhood, and we’ll both get between $5 and $200 toward a stock.