Choosing my third dividend stock: SCS.

I wasn't trying to choose a company from Michigan, but with a 5.9 percent dividend yield, Steelcase is a winner for me.

I never would have thought that making school and office furniture was big business. But in the example of Steelcase, it is.

The Grand Rapid, Michigan-based company made $2.8 billion in revenue in fiscal year 2022. That’s a lot of office chairs and school desks.

Although, officially, it only noted a profit of $4 million. Ooof.

But the companies revenues and the fact that it hails from Michigan aren’t what attracted me to the stock. In reality, I was initially interested in purchasing Walgreens stock, which has been consistently paying out dividends for more than 25 years.

Walgreens offers a 5.4 percent dividend yield, and its dividend payouts are well covered by earnings. And I was about to buy it, before I stumbled upon Steelcase, which offers a 5.9 percent yield that is also well covered earnings. And Steelcase has a cheaper stock, so I can by more of it.

Here’s what I found out about Steelcase/SCS using the dividend stock evaluating framework from The Single Best Investment by Lowell Miller.

High Quality. Steelcase has the money to cover both its short term and its long term debts. Both the the company’s revenue and its profits are expected to grow. And, according to the stock analysis website I’m using, simplywall.st, its stock is undervalued.

High Current Dividend Yield. The company has a dividend yield of 5.9 percent. The industry average for March 2023 is 1.7 percent. And the company has a high dividend payout ratio of 163 percent. That’s Fantastic!

High Growth Dividend. The analysts at simplywall.st believe that the dividends for Steelcases stock will continue to grow as its revenues and profits grow over the next few years.

All of this gets me excited and ready to begin investing in Steelcase.

So what’s next?

Honestly, after spending time researching and investing in stocks that earn dividends, I would love to watch the theory of efficient markets in my portfolio. I want to see how the three dividend stocks I’ve invested in this past month, perform head-to-head with my Vanguard High Dividend Yield ETF.

Stay tuned in future posts for more on that.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I look to grow my wealth through wise money management and making investments in cryptocurrency, index funds, stocks and more.

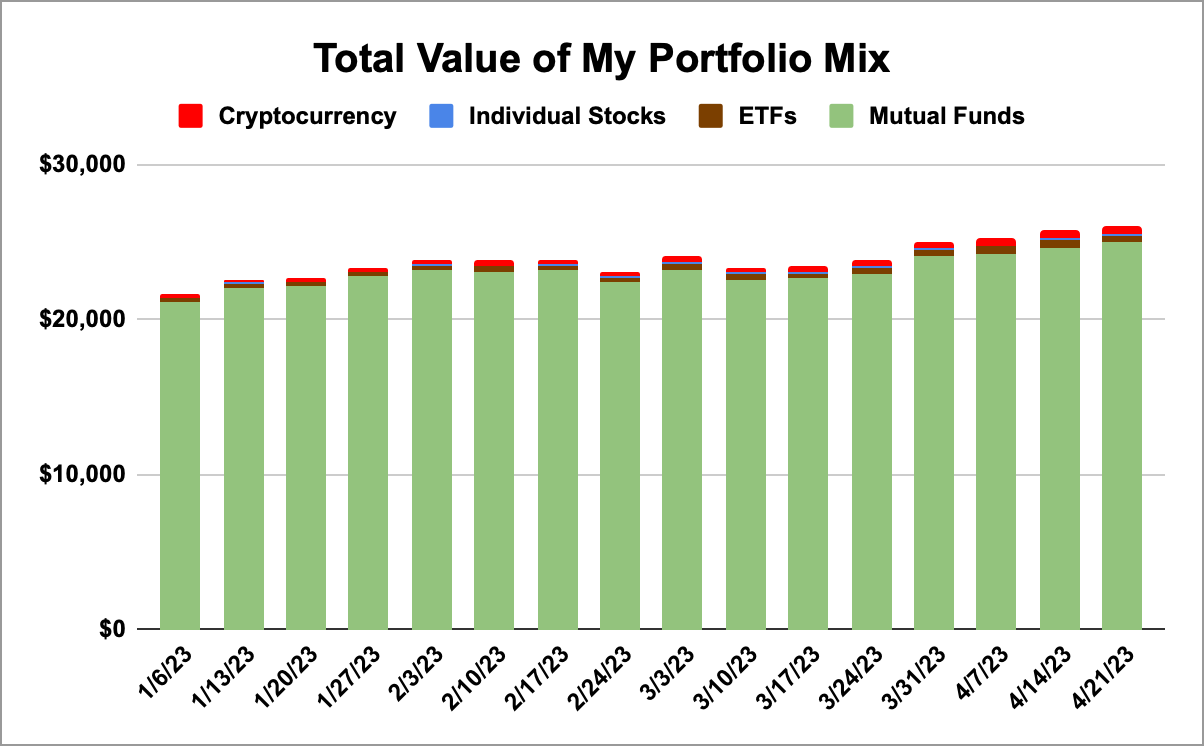

Let’s take a quick look at how my portfolio has been performing in the past week.

YTD invested (total): $2,076.09

YTD Growth: 10.9 percent

My Portfolio Holdings as of 4/21/23

Apple stock

HF Sinclair stock

Rocket Companies stock

Verizon stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

SPDR Portfolio S&P 500 Growth EFT

iShares S&P SmallCap 600 ETF

Vanguard FTSE Emerging Markets Fund

Invesco S&P 500 Momentum ETF

Vanguard FTSE Developed Markets ETF

Invesco S&P 500 Quality ETF

iShares Core S&P 500 ETF

Vanguard Total Bond Market ETF

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

💰 I help people finance homes for a living. If you’re looking to buy or refinance, use my link to get a sweet mortgage discount from Rocket Mortgage.

📈 Inspired to begin investing yourself? Use my link to open an account on Robinhood, and we’ll both get between $5 and $200 toward a stock.