Dollar-Cost Averaging: Investing with a plan, not out of emotion.

Just keep swimming, just keep swimming, swimming, err...investing.

As a general rule, I wouldn’t advise getting advice from a movie. Any advice; much less financial advice. But today I’m going to make an exception.

I think the memorable scene in Finding Nemo where Dory tells Marlin to “just keep swimming,” after they lose the diver’s mask with the address of Nemo’s captor written on it, provides an excellent picture of continuing to invest through losses.

Dory: “Hey Mr. Grump Gills. When life get’s you down, you know what you gotta do?”

Marlin: “I don’t want to know what you have to do.”

Dory: “Just keep swimming, just keep swimming, just keep swimming, swimming, swimming.

“What do we do? We swim.”

As silly as this scene in the movie may be, I think it offers profound investing advice.

When it comes to investing with the goal of long term portfolio growth, it’s important to continue investing even as a sagging, and often declining, market could have me second-guessing as to whether it makes sense for me to keep sinking cash into something that for the past several months has just lost me money.

What do fish do? They swim. What do investors do? We invest.

In the words of Dory, the Blue Hippo Tang fish, “just keep swimming.” Or in more regular financial terms, lean into dollar-cost averaging.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in crypto-currency, index funds, stocks and more.

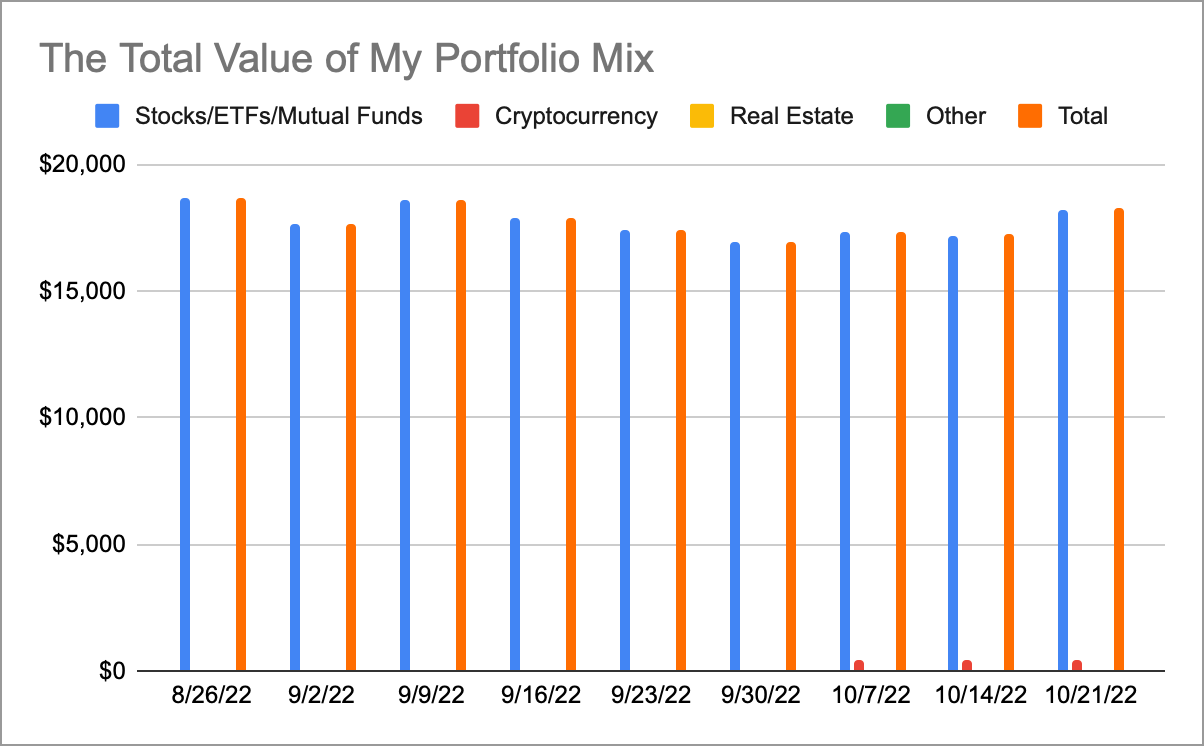

Before discussing the dollar-cost average investing strategy, let’s take a quick look at how my portfolio has been performing.

My Portfolio Holdings as of 10/21/22

Apple stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

My portfolio did great last week, growing by more than five percent. I’m not jumping for joy about the gains though. They could easily be wiped out this upcoming week. The general economic outlook for the near future continues to appear grim.

The brewing economic storm makes discussing the dollar-cost average investing strategy very timely.

What is dollar-cost averaging? It’s an investing strategy that seeks to reduce the impact of market highs and lows by spreading out investment purchases over time, instead of making a one-time lump sum purchase of a particular investment like a stock.

The benefit of this strategy is that it ensures that I’m not buying an investment at it’s highest price as well as gives me a great chance of “buying the dip” and purchasing an investment when its price is at its lowest in a market cycle.

For me, this looks like taking a portion of every paycheck and directing it toward my employer-backed investments.

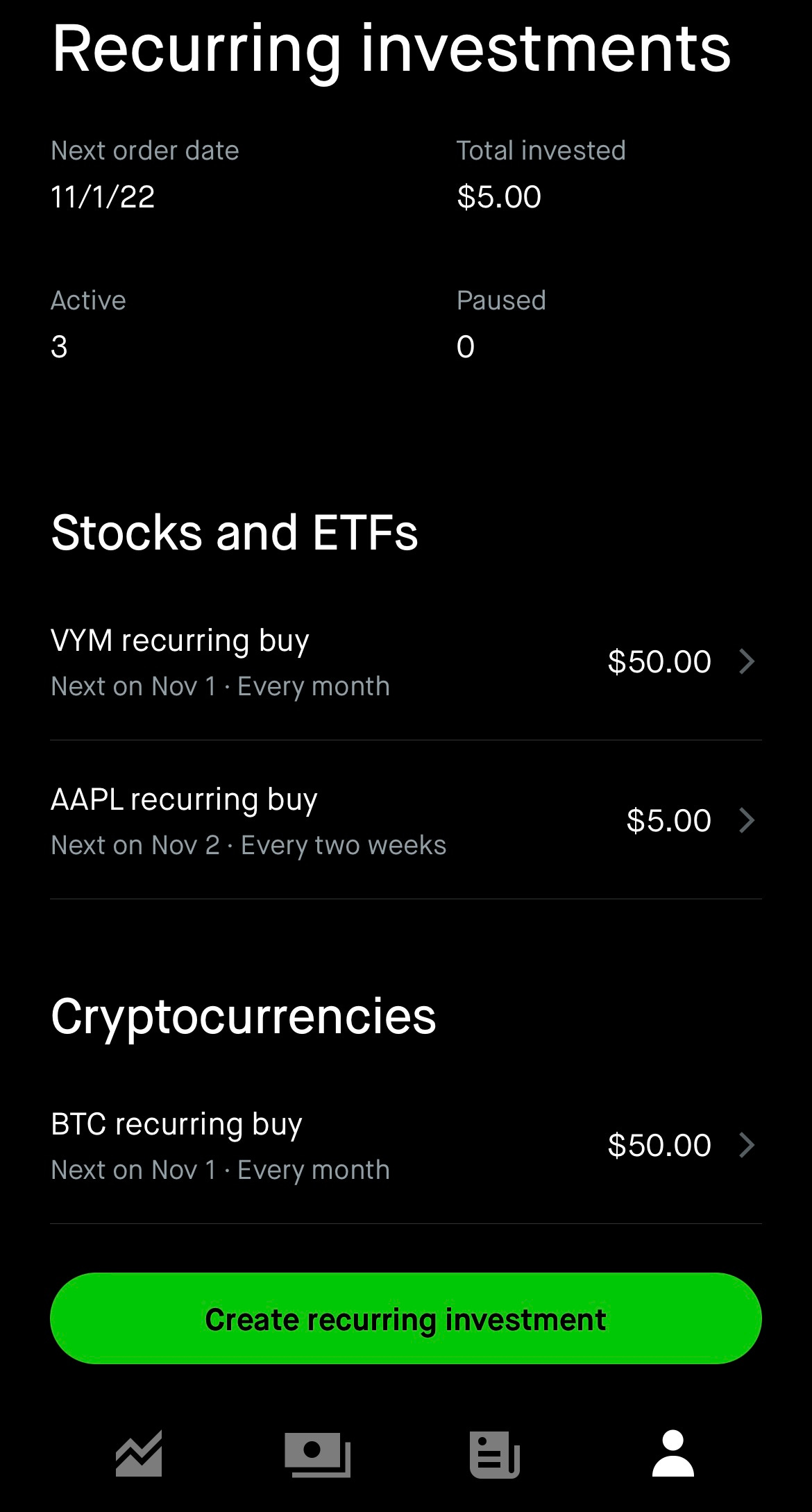

It also looks like me setting up recurring investments in my Robinhood app, so that my account automatically purchases $50 worth of Vanguard High Dividend Yield ETF and $50 worth of Bitcoin on the first of every month as well as makes a $5 investment in Apple stock once every two weeks.

If you already have a brokerage account that you use to purchase investments, setting up a recurring investment to take advantage of the dollar-cost average strategy is easy.

If you don’t have an account with a service that allows you to buy and sell investments, like stocks, consider downloading Robinhood on your smartphone using my link. As a benefit for using my link, we both get between $5 to $200 toward a free stock. Pretty neat.

And when it comes to dollar-cost averaging, it doesn’t take much to start.

For someone who is just beginning their investing journey, opening a brokerage account with a service like Robinhood and investing $5 a week is a meaningful step toward long term portfolio growth.

Right now, I only purchase $10 of Apple stock per month.

Still, the tiny steps forward matter. When it comes to money, the small, positive steps forward today compound and lead to more substantial growth in the future.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.