Don't forget to vote today.

Seriously — make your voice heard.

By the time this newsletter goes out today, I will be helping administer an election in the Detroit metro area. Much like how our financial system is the sum of billions of small (and some not-so-small) transactions every day, I’m amazed by how elections are decided by the cumulative impact of millions of Americans simply exercising their right to vote.

The future matters, and that future isn’t only determined by the ebb and flow of the markets.

If you’re reading this on November 8, 2022 and you haven’t voted yet, vote. Scratch that; do your research on the candidates and issues you’ll be voting on. Develop a conviction. Then vote.

And being that I had a lot going on this past weekend, and needed to get to bed so I could get at least a few hours of sleep before having to wake up at five a.m. to work at the voting precinct this morning, this week’s post will be brief.

Sorry. But also, not sorry. This newsletter is free.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in cryptocurrency, index funds, stocks and more.

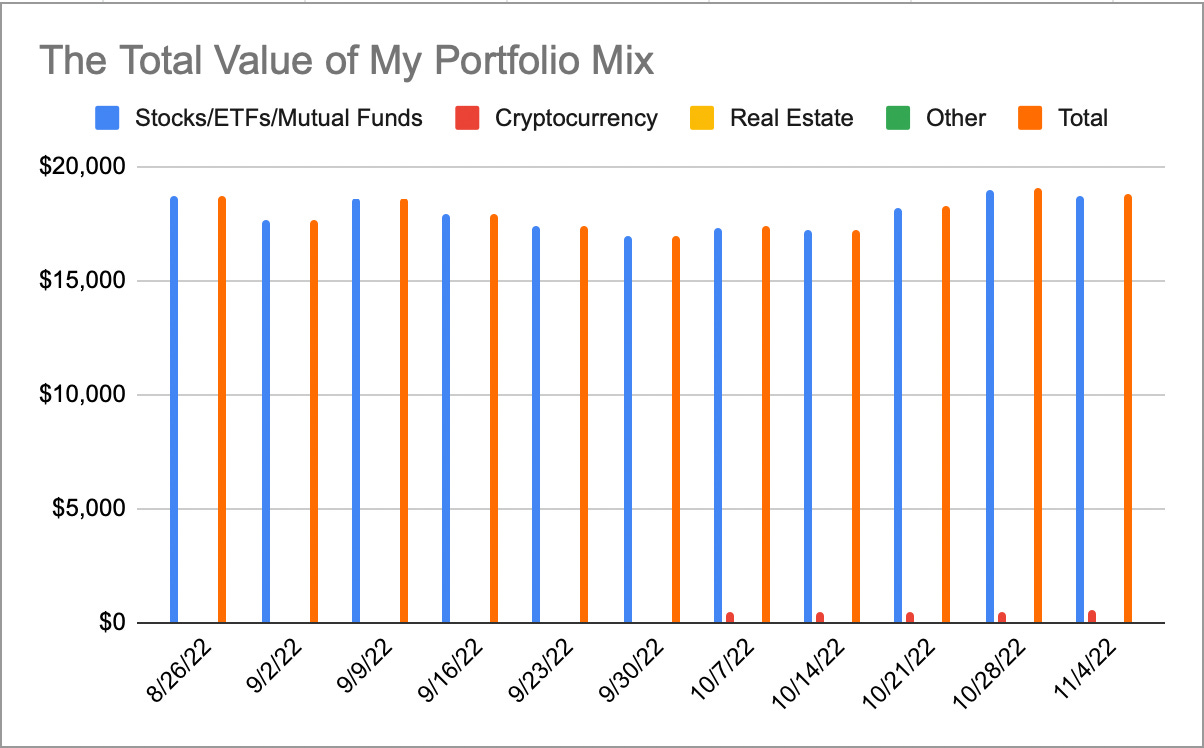

Before recapping the most helpful financial lessons I’ve learned over the last couple months of this investing journey, let’s take a quick look at how my portfolio has been performing.

My Portfolio Holdings as of 11/4/22

Apple stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

Last week the Federal Reserve announced another rate hike (here’s what that means), the US tech industry announced mass layoffs and my portfolio lost money.

I’m becoming a broken record, but unless something dramatic changes, I’m staying the course. I’m playing the long game, and right now stocks are on sale.

Now that we’ve settled that, here are the top financial lessons I’ve learned exploring investing over the past several months:

A well-invested portfolio of stocks will grow over time. Buying stocks that pay dividends super-charges this. Hat tip to Lowell Miller, and his book The Single Best Investment: Creating Wealth with Dividend Growth.

The #1 rule in building wealth is spending less than you make. Hat tip to Graham Stephan.

Dollar-cost averaging gives me a great chance of “buying the dip” and purchasing an investment when its price is at its lowest in a market cycle. I’m learning to love the recurring investments feature on my Robinhood app.

Inflation sucks. But one silver lining may be that I can finally make money with my dollar. At the end of October financial services were offering interest rates as high as 4 percent on a CD with a one year term and 3.12 percent over the course of a year with a high yield savings account.

In every challenging market is an opportunity to create wealth. Even with rough economic conditions, there’s a lot to be excited about right now.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.