Figuring out where to go next with my portfolio.

I want to develop a more well thought out approach for making investing decisions moving forward.

I’ve found that in the process of learning something new, my investigations often produce more questions before they provide me with any answers. And as I’ve looked to tackle investing, this has been my experience as well.

Three months ago, as I was looking at my portfolio at the beginning of this saga, I noted two things about my portfolio. First, that it was totally comprised of mutual funds. And second, that those mutual funds were all tax advantaged, though I didn’t use those words.

As a reminder, a mutual fund is a professionally managed basket of investments such as stocks, bonds, commodities or other assets.

Moreover, an investment that is “tax advantaged,” offers tax benefits due to the specified legal structure of the investment. Or in my situation, the investment into a Roth IRA is made with “aftertax” dollars, and then as long as certain specifications are met, isn’t taxed coming out.

And from everything I’ve learned over the past three months, it was a pretty solid investment strategy.

Yet, as I’ve been investing more actively these past several months, I’ve taken a completely different track. I’ve invested about $400 over-and-above my (tax advantaged) employer-backed plan and none of my investments have been in mutual funds.

I’ve explored investing with Bitcoin, EFTs (which are like mutual funds, but are traded on an exchange) and individual stock.

Most of these investments have not been tax advantaged.

On one hand, this is great because the funds are “liquid” and I can convert them back to cash almost whenever I want without paying any sort of financial penalty. On the other hand, this stinks because when I do take my money out, I’m going to have to pay capital gains taxes to Uncle Sam. That is, assuming my investments actually make money.

As I’ve looked back over the past several months, I’ve realized that I haven’t really had an investment strategy beyond just wanting to learn what it’s like to hold different types of investments.

This has been fine up to this point because I haven’t invested that much money. But moving forward, I want to have more of a plan.

Why pay the government more than absolutely necessary?

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in cryptocurrency, index funds, stocks and more.

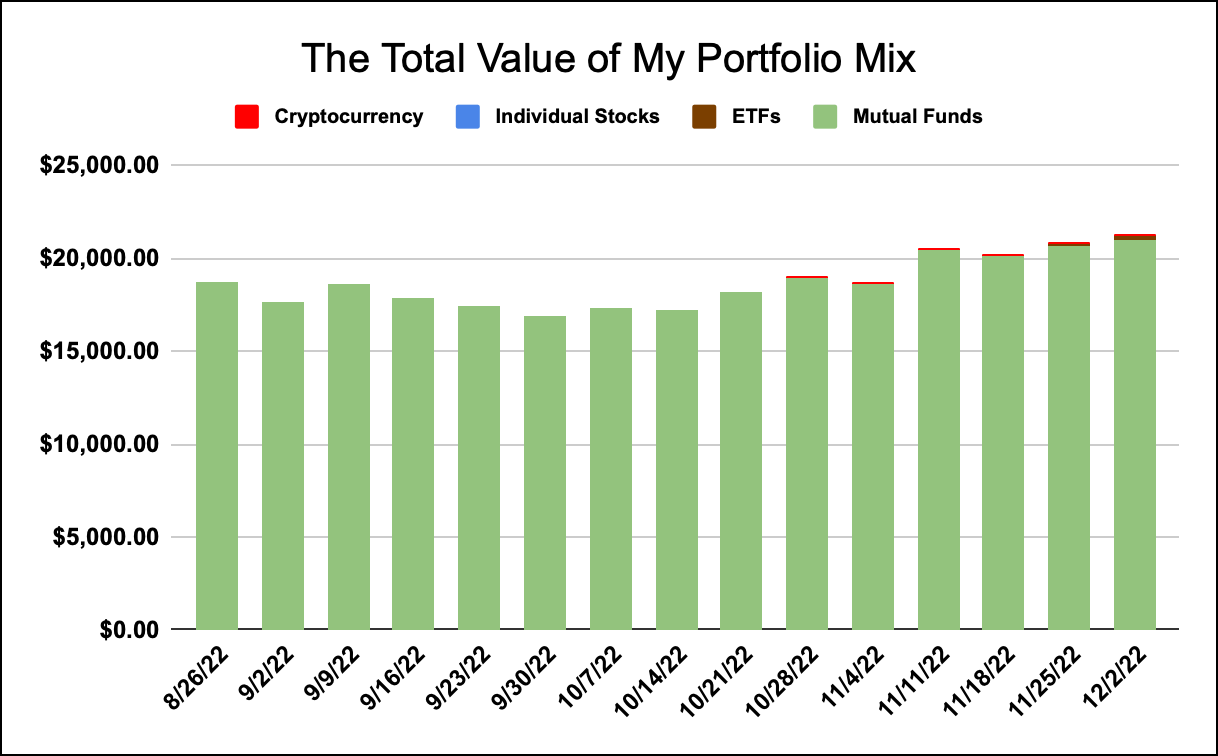

Before discussing how I plan to develop a more strategic and informed investment strategy, let’s take a moment to appreciate my newly configured portfolio chart. Isn’t it so much cleaner than the old chart?

And the new chart was suggested by one of the subscribers of Evan Invests. Magical things happen when readers give feedback.

Anyhow, thank you for indulging me. Let’s take a quick look at how my portfolio has been performing.

My Portfolio Holdings as of 12/2/22

Apple stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

I’ve enjoyed seeing the stock market do marginally better over the past several weeks, which has helped the overall value of my portfolio. And while this hasn’t really affected my overall portfolio that much, I’ve been glad to see the price of Bitcoin continue to recover following the collapse of FTX.

Okay, so what am I doing moving forward? I’m not quite sure yet.

I need to develop some sort of grid for what my investment strategy is and how much of my investing I want to be tax-advantaged (in an IRA) and how much I want to be non tax-advantaged and able to be instantly converted into cash.

Early into this journey, one of my subscribers, who used to be a financial advisor, lent me the book The Single Best Investment by Lowell Miller. I’ve skimmed a few chapters, but haven’t finished it all the way yet.

Moving forward, I think my first step will be to read this book. As I read the book, I’ll share what I’m learning, and if anything I’ve learned impacts my current investing strategy.

And as I do that, this newsletter may look a bit different. I hope to continue posting every week — avoiding a situation like last week where I didn’t post. Whoops.

We’ll see where this goes next. I’m thankful you’re along for the ride. While I don’t totally know where it’s going, I know it will be exciting.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

💰 I help people finance homes for a living. If you’re looking to buy or refinance, use my link to get a sweet mortgage discount from Rocket Mortgage.

📈 Inspired to begin investing yourself? Use my link to open an account on Robinhood, and we’ll both get between $5 and $200 toward a stock.

The chart is much improved! I like it.