Growing my income will allow me to invest more. Right now I'm concentrated on making that money from my 9-to-5.

I don't have a side hustle and I'm not worried about it.

Hustle culture is huge. As I search through Twitter to find my favorite financial Tweet every week, or as I look at content from different finance YouTubers, a lot of them are talking about all of the different ways they make money. Multiple streams of income, ect.

I’m not against side hustles or multiple streams of income. I have an LLC so I can receive income from odd-jobs, or from occasional clients I have for photography or writing.

And I know people who are successful making income from their passions in life in addition to their more traditional careers. Some of those side hustles are very lucrative.

But I’ve come to the conviction that in my stage of life it’s more important for me to have balance than it is for me to spend all of my extra time working to earn more money.

And actually, as someone in his late-20s, focusing on growing in my 9-to-5 career is one of the best ways I can increase my income.

Patrick Bet-David is one of my favorite financial commentators. And I think Patrick sums up this idea well when he talks about how he focused on one stream of income from his business instead of trying to make money from multiple streams of income.

I want to do what Patrick did. I’m not a business owner like Patrick, but I see the value in growing my main stream of income from my career in this stage of life, so I can have greater resources later in life to potentially try other things.

Cost controls are important. So is beginning to invest early to reap the benefits of compound interest.

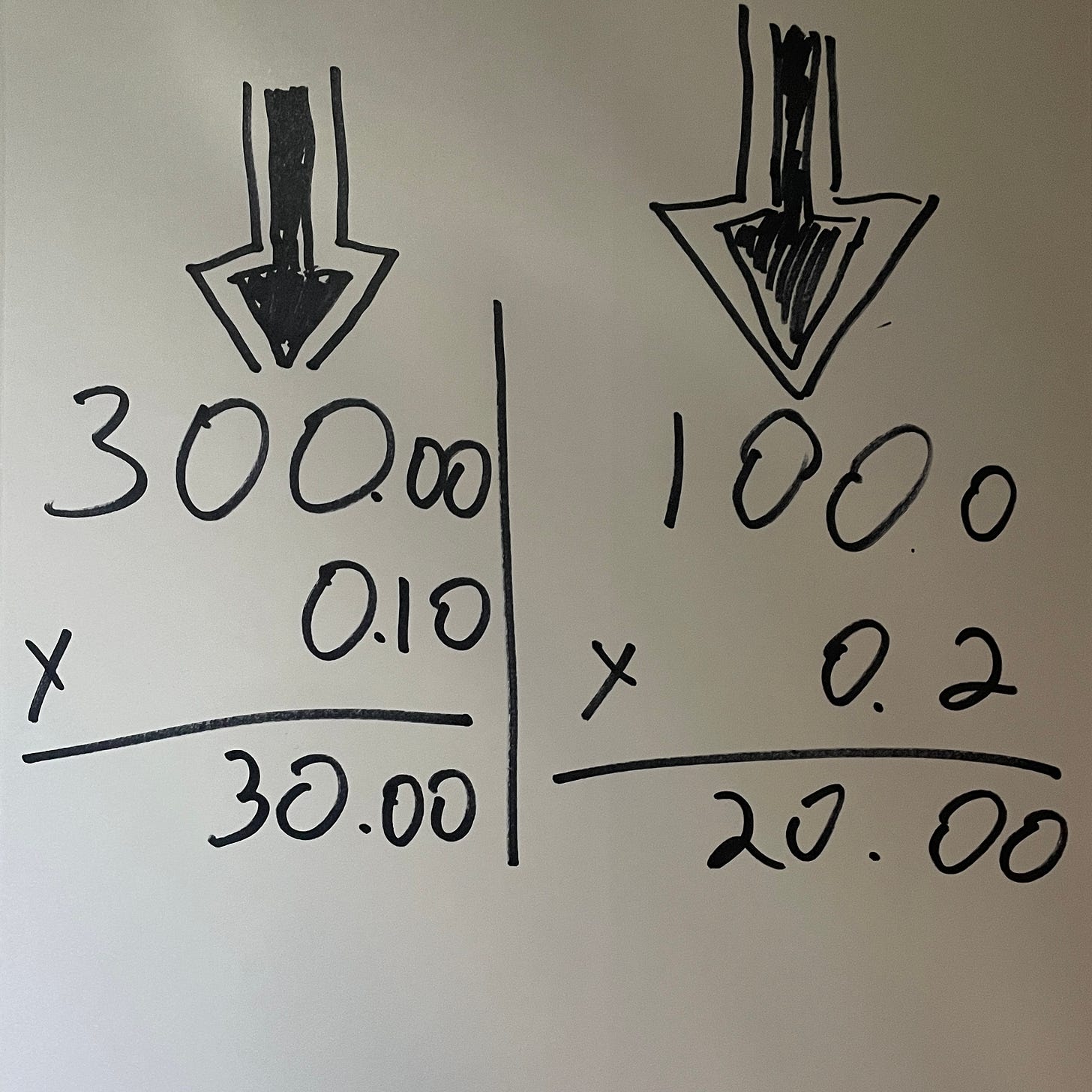

Still, it doesn’t take very sophisticated math skills to see how investing more money because I have more money to invest will lead to better returns than situations where I invested less. Even if the investments I made with the lower initial investment amount performed twice as well.

I guess it’s time for me to focus on growing as a professional, so that as my professional career grows, other areas of my life can grow along side it.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I look to grow my wealth through wise money management and making investments in cryptocurrency, index funds, stocks and more.

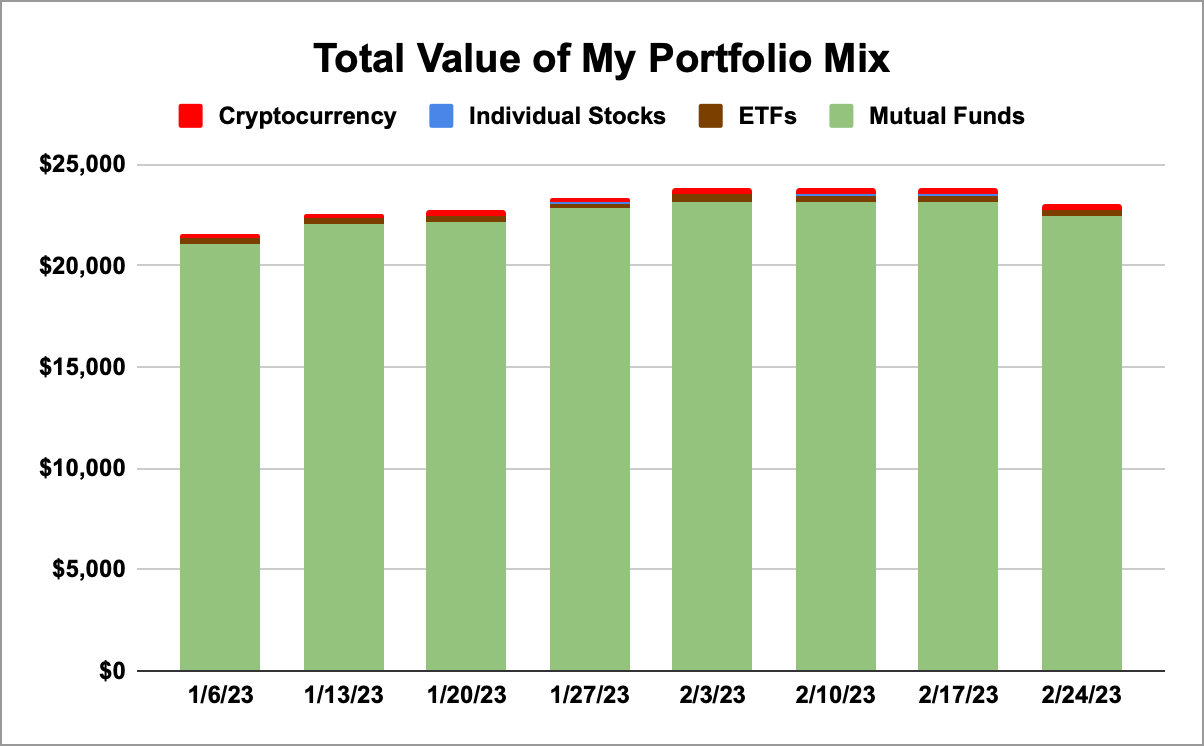

Let’s take a quick look at how my portfolio has been performing in the past week.

My Portfolio Holdings as of 2/24/23

Apple stock

Rocket Companies stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

The markets had a tough week last week, and so did my portfolio. Every single one of my assets lost value in terms of its price. Thankfully, I’m in this for the long game, and I’m not worried about making money week to week.

This week’s post was simple, so I don’t have much more to say. But before I go, I want to thank you for continuing to read this newsletter week after week.

There are so many things to which you could be giving your attention. There is more financial newsletters out there than you could ever read.

Thanks again for giving me five minutes out of your Monday.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

💰 I help people finance homes for a living. If you’re looking to buy or refinance, use my link to get a sweet mortgage discount from Rocket Mortgage.

📈 Inspired to begin investing yourself? Use my link to open an account on Robinhood, and we’ll both get between $5 and $200 toward a stock.