Investing in Cryptocurrency following the collapse of FTX.

"Not your keys, not your crypto."

As I checked the value of the holdings on my Robinhood app throughout last week, I noticed it was dropping by a little bit every day. I didn’t think anything of it, and figured that my losses were coming from the stock market.

Then last Friday, I took a deeper look at my portfolio after work. Woah!

The value of my Bitcoin had dropped by about $30, meaning that my Bitcoin holdings had lost more than 20 percent of its value. In a week.

I knew that Bitcoin was a volatile asset when I began buying it last month, but I never expected this.

Then upon doing just a little bit of research — by which I mean I visited YouTube — I quickly figured out why the price of Bitcoin had tanked so much last week. FTX, the world’s second largest cryptocurrency exchange, had suspended the onboarding of new clients as well as withdrawals until further notice on Thursday (11/10).

While my Bitcoin wasn’t invested in FTX’s platform, the cryptocurrency trading platform’s collapse has sent shockwaves through the entire cryptocurrency industry and has caused me to rethink how I look at investing in Bitcoin.

So I called a friend who is a more seasoned cryptocurrency investor than me, and asked him how to best respond in light of the collapse of such a mainstream cryptocurrency exchange.

Over the course of our conversation, one phrase he said stuck out to me: “Not your keys, not your crypto.”

The collapse of FTX, and the unfortunate prevalence of scams in the emerging market of cryptocurrency investing, haven’t caused me to lose my interest in Bitcoin. But I did know I wanted to get my cryptocurrency off of Robinhood and onto something that won’t go to zero if Robinhood ever goes belly-up.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in cryptocurrency, index funds, stocks and more.

Before discussing what “not your keys, not your crypto” even means, let’s take a quick look at how my portfolio has been performing.

My Portfolio Holdings as of 11/11/22

Apple stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

Investing is weird sometimes, and having a diversified portfolio can mean that while one of my asset holdings loses value, other asset holdings gain value.

This is exactly what happened with me last week.

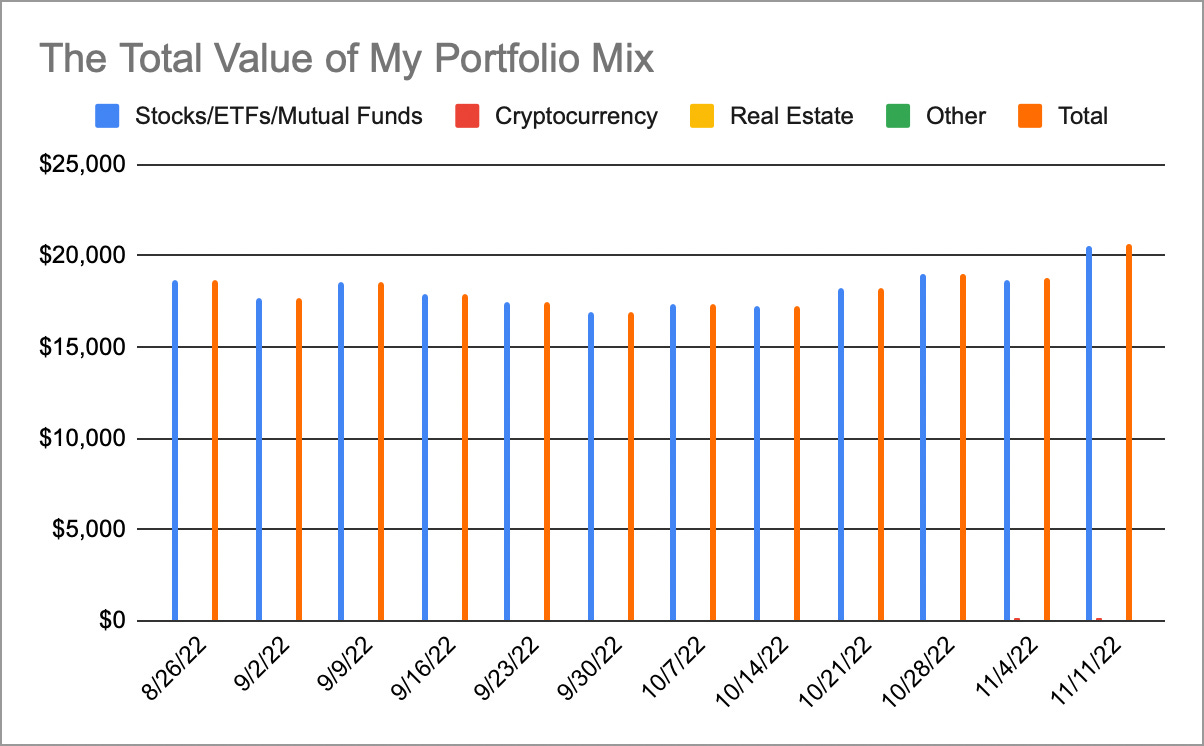

While my Bitcoin lost more than 20 percent in a week, the value of the stock-based portion of my portfolio (which makes up the majority of my portfolio) surged. For the first time in this two-and-a-half month journey, the total value of my holdings rose above $20,000. Neat. And now I’m going to continue dollar-costing my stock and index fund investments.

OK — Let’s get back to securing my Bitcoin.

First, I want to make clear that while the collapse of FTX did rattle much of the cryptocurrency market, I don’t have any reason to believe Robinhood’s cryptocurrency brokerage is headed toward any issues.

What the collapse of FTX did solidify in me is that I wanted to have more control over my Bitcoin, so that I would never be in a position where I lose all my investment due to the mismanagement of a financial institution with which I’m working.

This is where “not your keys, not your crypto” comes in. In short, the phrase means that unless I, as the owner of Bitcoin, have a cryptocurrency wallet storing the private keys that actually prove I own the Bitcoin, then I don’t actually have full control of my Bitcoin.

If Robinhood’s cryptocurrency exchange went down while my funds were still on it, I might never see them again. With a cryptocurrency wallet, this doesn’t happen. Since I have full control over my Bitcoin’s private keys, I have full control over my Bitcoin.

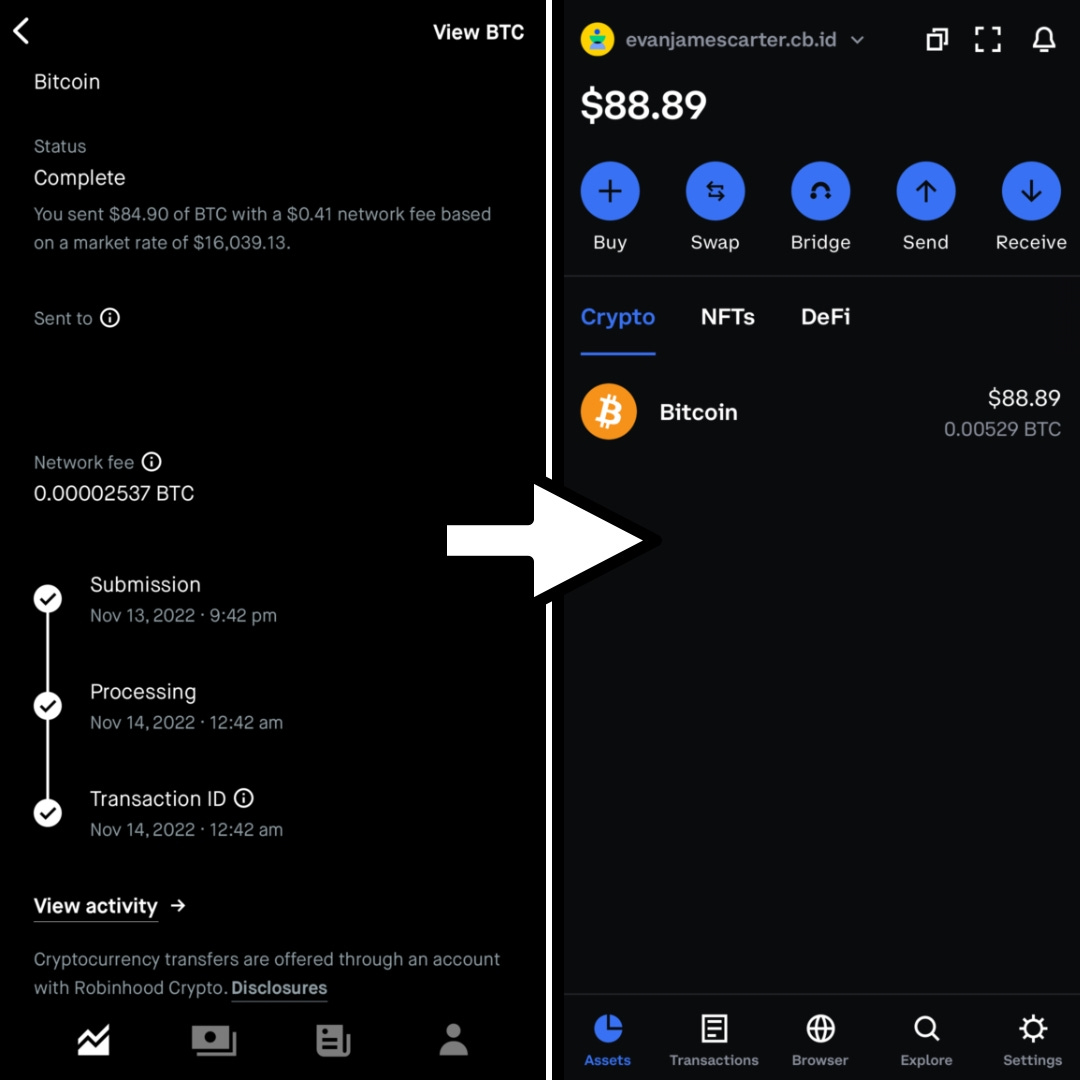

So after talking with my cryptocurrency enthusiast friend, I decided to transfer my Cryptocurrency from Robinhood’s exchange to Coinbase Wallet, a digital cryptocurrency wallet that’s connected to the internet.

I’m satisfied using Coinbase Wallet for now considering that my Bitcoin portfolio is so small, even though cryptocurrency wallets connected to the internet are not totally secure, due to the possibility of hacking.

If my Bitcoin portfolio continues to grow, I may get more sophisticated and purchase an offline, and therefore un-hackable, Bitcoin wallet like those sold by either Trezor or Ledger.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

💰 I help people finance homes for a living. If you’re looking to buy or refinance, send me a DM, and I’ll hook you up with a sweet mortgage discount from Rocket Mortgage.

The FTX story really highlights the fundamental concept of individual stock investing that you should never invest heavily in something you don't personally understand. The best investors are the best because they have learned and understand the fundamentals of the companies and can validate why they are investing the way they are (for the most part), compared to most individuals (myself included) who are relying mostly on what we hear from others on the internet, which opens us up to risk in the form of bad actors directing us to pyramid schemes like FTX. The whole thing is fascinating. Thanks, Evan!