Investing within my means

Continuing to invest, even if it means starting small and accepting short-term losses.

A couple months ago I was listening to the audiobook version of Atomic Habits, and one of the vignettes James Clear shared about the futility of trying to achieve progress through getting something “just right” has stuck with me ever since.

Clear shares about an experiment preformed by a photography professor at the University of Florida, who divided his class into two groups on the first day. The first group would be graded solely on the number of photos they took and the second group would be graded only on the excellence of their photos, or even a singular photo.

At the end of the semester the professor found that all the best photos were produced by the quantity group, not the quality group. The students who spent their time doing photography took better photos than those who simply thought about taking a great photo. (You can read what Clear had to say about the experiment on his website.)

The take away is impossible to miss: Just taking steps forward, even imperfect or small ones, produces a better result in the end then trying to produce perfection all at once.

Today I’m putting that lesson to work by finally taking the next steps in my investment journey and writing this post after spending the past month trying to figure out what to do next. I’ll explain below.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in crypto-currency, index funds, stocks and more.

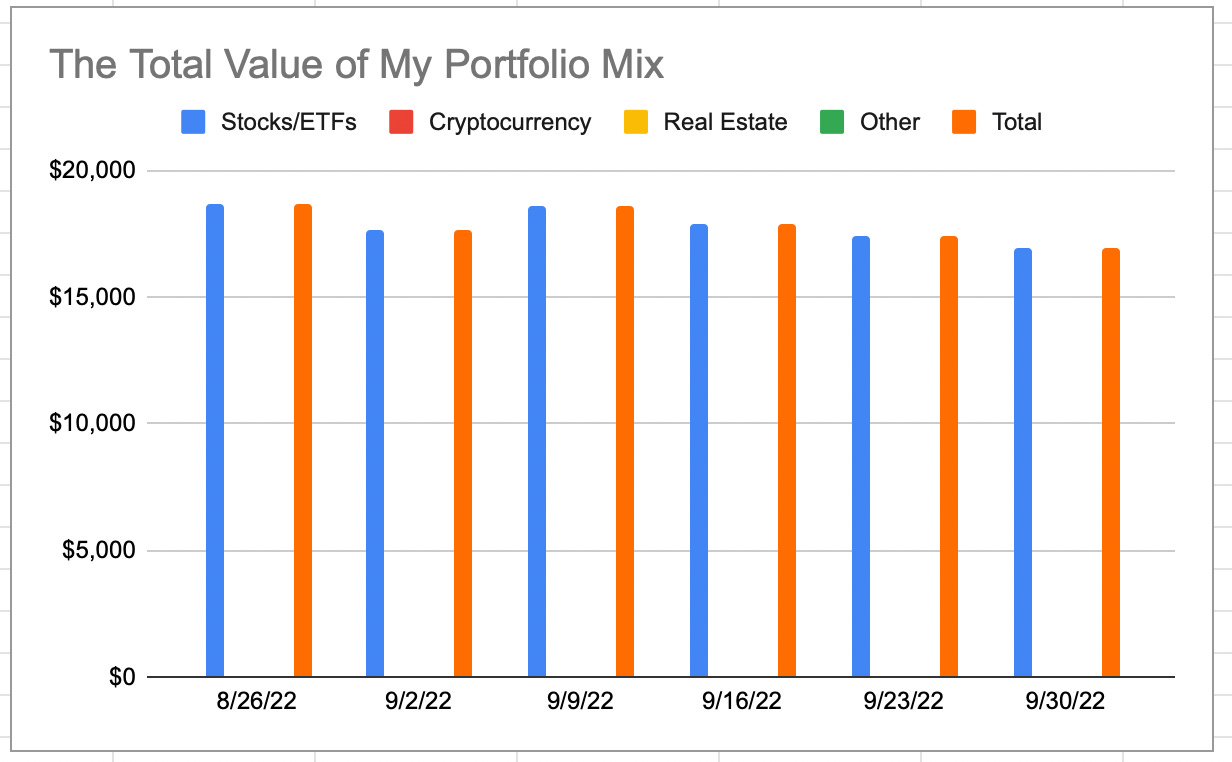

My portfolio has taken a beating over the past month.

This is obviously the case for virtually every investor holding stocks right now, but this is the first time I’ve seen my portfolio experience losses of more than 10% of its total value since I’ve been paying attention.

I already was invested in my Vanguard index funds when the stock market plunged in March 2020 as the world began locking down due to COVID-19, but I wasn’t paying any attention to them, so I was oblivious to the losses I was experiencing.

Now I’m paying attention, learning to process the losses, and actively continuing to invest.

In my last post, Staying the Course and doubling down, I set a goal of amassing a portfolio of $2.5 million by the time I’m 65, and then used a tool from NerdWallet to see if I was on track to hit my goal. I wasn’t.

The solution I came to was either that I could increase my income to have more money to invest, or I could look through my budget to find more money to invest at my current level of income. I didn’t get a new job over the past month and I haven’t gotten a raise, so I decided to look at my budget.

As a quick aside, if you’re reading this and don’t have a budget, make one. It’s the foundation of a strong financial future, and is the tool that allows me to know how much money I’m able to invest every month.

I use YNAB to help me budget and there are several great options available, some free and others costing money.

Anyhow, after looking through my budget, I was able to find a couple hundred dollars that I could shift around, but I only ended up increasing my investment budget from $50-per-month to $75-per-month, with the rest of the money going towards saving for the down payment on a house.

Over the past month, as I looked at my meager $75 month investment budget (supplementing my employer-backed plan) and the mounting loses of my portfolio, I froze. I didn’t know what to do, so I didn’t do anything.

While I know in my head that for investors with a long-term strategy, a market downturn simply means more stocks and index funds can be purchased for the same amount of money, I still had a sinking feeling while I looked at the markets.

Thankfully, I have incredible friends, and after a rhetorical kick-in-the-pants, I made a couple investments:

$100 of Vanguard High Dividend Yield ETF (Inspired by Lowell Miller’s book The Single Best Investment: Creating Wealth with Dividend Growth)

$50 of Bitcoin

I don’t know where the market is going next, but I do know that the only way for me to grow my portfolio is to continue learning and to continue making (wise) investments.

Let’s see where this goes. I’ll report back next week.

If you enjoyed this piece, hit that like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

A great update! I hadn't heard of Lowell Miller's book before - I'll check that out.