Keeping my investment gains away from Uncle Sam.

Now that Robinhood is offering a 1 percent match on IRAs, I have no excuse not to use tax-advantaged investing.

Since beginning to invest last August, I’ve largely invested through my Robinhood app’s brokerage account. This means that if I was to sell my investments and withdraw my funds, I would have to pay capital gains tax.

It wouldn’t have to pay a ton of capital gains taxes as my investments have gained less than $50 over and above the more than $600 I’ve invested, but I would still have to pay it.

But my goals for investing aren’t short-term goals, and eventually the amount of money I have invested will greatly exceed $600 and the gains will (likely) greatly exceed $50. So I need to plan for what happens when I do want to withdraw my invested funds. And when I do, I want to pay as little in taxes to Uncle Sam as possible.

Enter tax-advantaged retirement plans: The traditional Individual Retirement Account, and my favorite, the Roth Individual Retirement Account.

By contributing money to a Roth IRA, I contribute “post-tax dollars” so that once I hit 59 and a half years old — or have another qualifying event like a first time home purchase — I don’t pay any taxes on the money I gained over-and-above my original investment.

Further, I can withdraw the money I invested in my Roth IRA at any time without penalty. It’s when I withdraw the profits gained by the investments in this account that Uncle Sam gets to take a hefty cut.

And the great thing is, I can contribute up to $6,500 into a Roth in 2023. That’s way more than I’m planning to invest, so I have years of growth in my investing before I’ll have to worry about investing outside of a tax-advantaged account unless I have a good reason to do so.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in cryptocurrency, index funds, stocks and more.

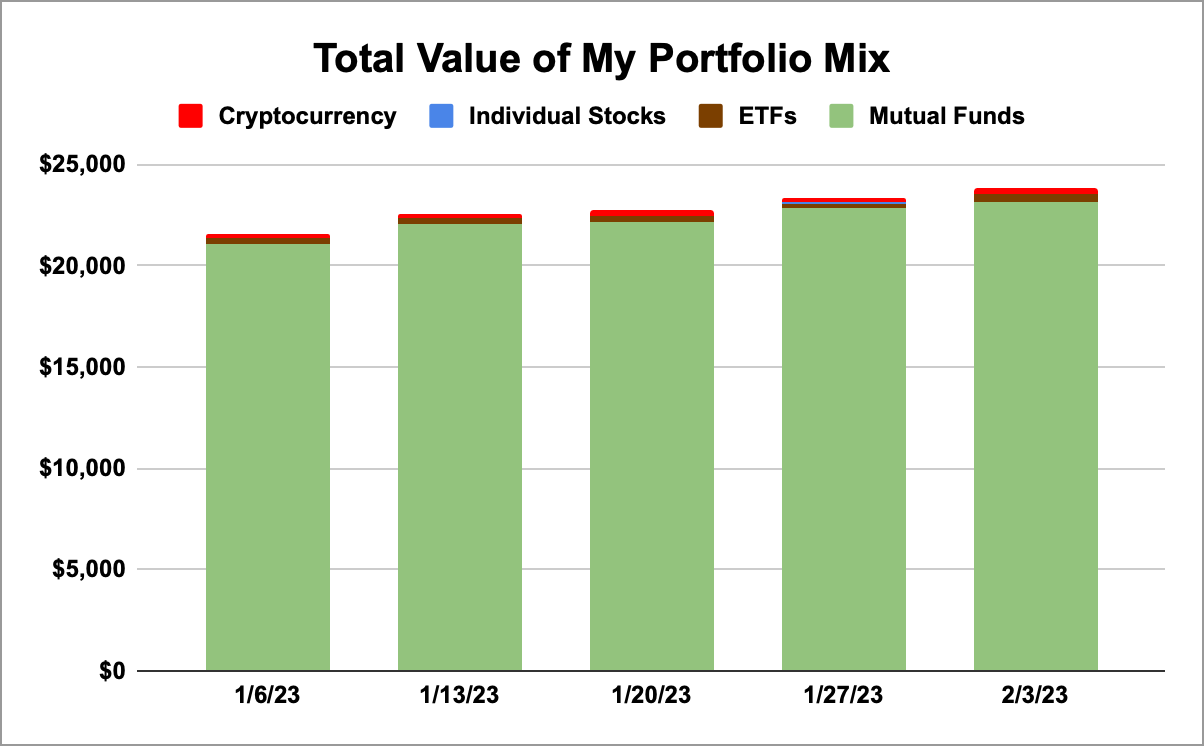

But before continuing to talk about tax advantaged investing and my Roth IRA, let’s take a quick look at how my portfolio has been performing.

My Portfolio Holdings as of 2/3/23

Apple stock

Rocket Companies stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

Unfortunately I’m running out of ways to say this, but my portfolio didn’t move again last week. The stock market, which comprises most of my investments, continues to sag. One bright spot is that Bitcoin almost hit $24,000 last week, which is encouraging to see.

Alright, so back to my Roth IRA.

In the first six months of my investing journey, I rarely invested using a tax-advantaged account. But that all changed at the beginning of this month.

Earlier this year, Robinhood began a promotion where they give a 1 percent match for every dollar invested in a traditional or Roth IRA.

If you don’t use Robinhood to make your investments, there are several other great options for setting up an IRA as well.

I’m all in on tax-advantaged investing. Uncle Sam can take a chunk out of someone else’s capital gains.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

💰 I help people finance homes for a living. If you’re looking to buy or refinance, use my link to get a sweet mortgage discount from Rocket Mortgage.

📈 Inspired to begin investing yourself? Use my link to open an account on Robinhood, and we’ll both get between $5 and $200 toward a stock.