One week in: My experience investing in Bitcoin

Investing in cryptocurrency has been a ton of fun. I hope it ends up being profitable.

When I was a freshman in college, I wrote a research paper for an English class explaining what a Bitcoin is and why anyone would buy one. If I remember correctly, I got a C on the paper. The professor was intrigued by what I had to say, but thought that overall the whole thing was confusing.

First, that professor gave out Cs for average college work, so it’s not like my paper was bad, it just wasn’t exceptional.

Second, I don’t blame him for feeling confused. Most people don’t really understand Bitcoin, or other cryptocurrencies.

Thankfully, it seems Bitcoin is past the phase where the average person reading the news only associates it with buying drugs or other elicit substances online. And now it has moved to the slightly better position of being promoted by movie stars in TV ads and called a Ponzi-scheme by traditional financiers like the head of JPMorgan Chase bank, Jamie Dimon.

Jokes aside, while Bitcoin has come into the main stream over the past few years, it and other cryptocurrencies are still looking to find a footing among more traditional investments like stocks, bonds and commodities.

For those with a libertarian streak like myself, Bitcoin and other cryptocurrencies are attractive because they’re not controlled by a central bank, like the United State’s Federal Reserve, and they can be used online much like I might use cash at a physical store.

As an investment, Bitcoin is extremely volatile. In the six months prior to me purchasing it, its price went down more than 50%.

So now that I’ve gone from being interested in Bitcoin to being invested in it, I’m trusting that this revolutionary financial investment will have enough staying power for me to profit off of it in the long run.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in crypto-currency, index funds, stocks and more.

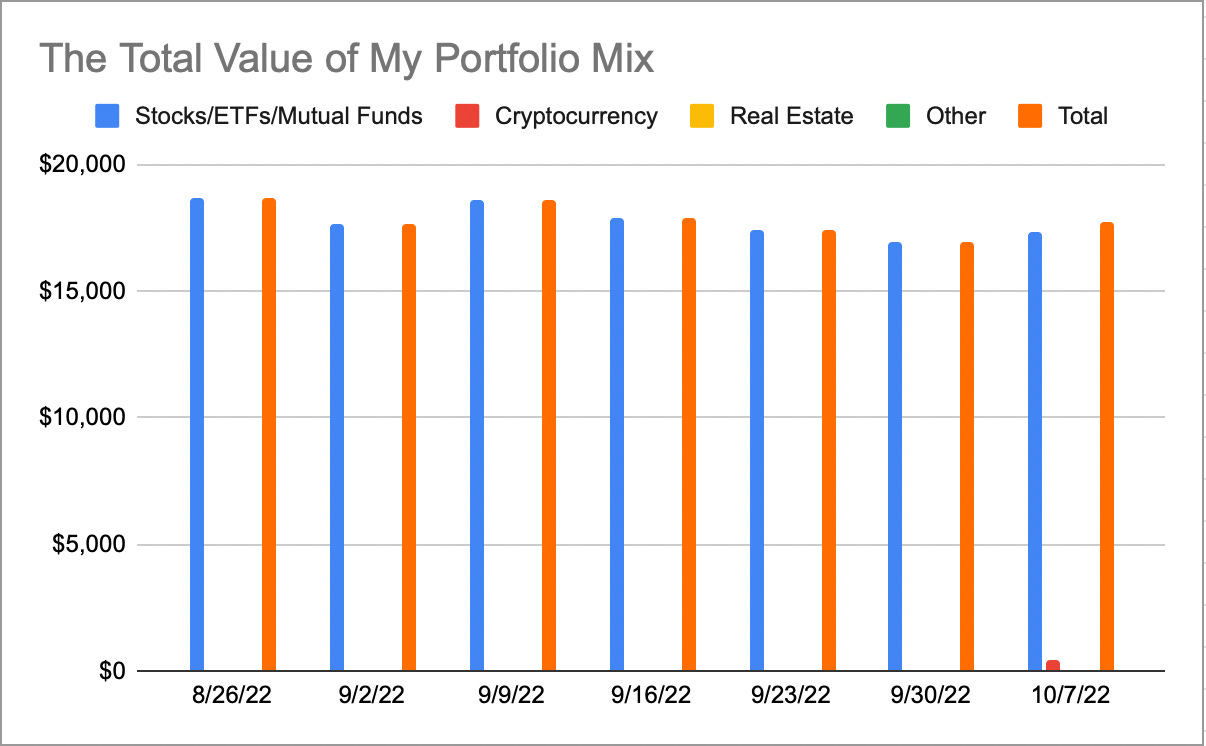

My portfolio continues to sag, as stocks and Bitcoin were more or less flat the past week.

I was paid this past Friday, so my employer-backed index funds, purchased through Fidelity, got a nice injection of cash.

Overall, since I began this adventure more than six weeks ago, I’ve sunk more than $800 into my investments between my employer-backed and personal funds even as the value of my portfolio seems to continue to decline.

In the face of sustained losses, I continue to remind myself that the stock market, and now Bitcoin, is on sale at the moment. I’m investing with a long view in mind, so I can afford to buy for the value of the investment and not the price.

And, alongside its financial value, owning Bitcoin is so much fun.

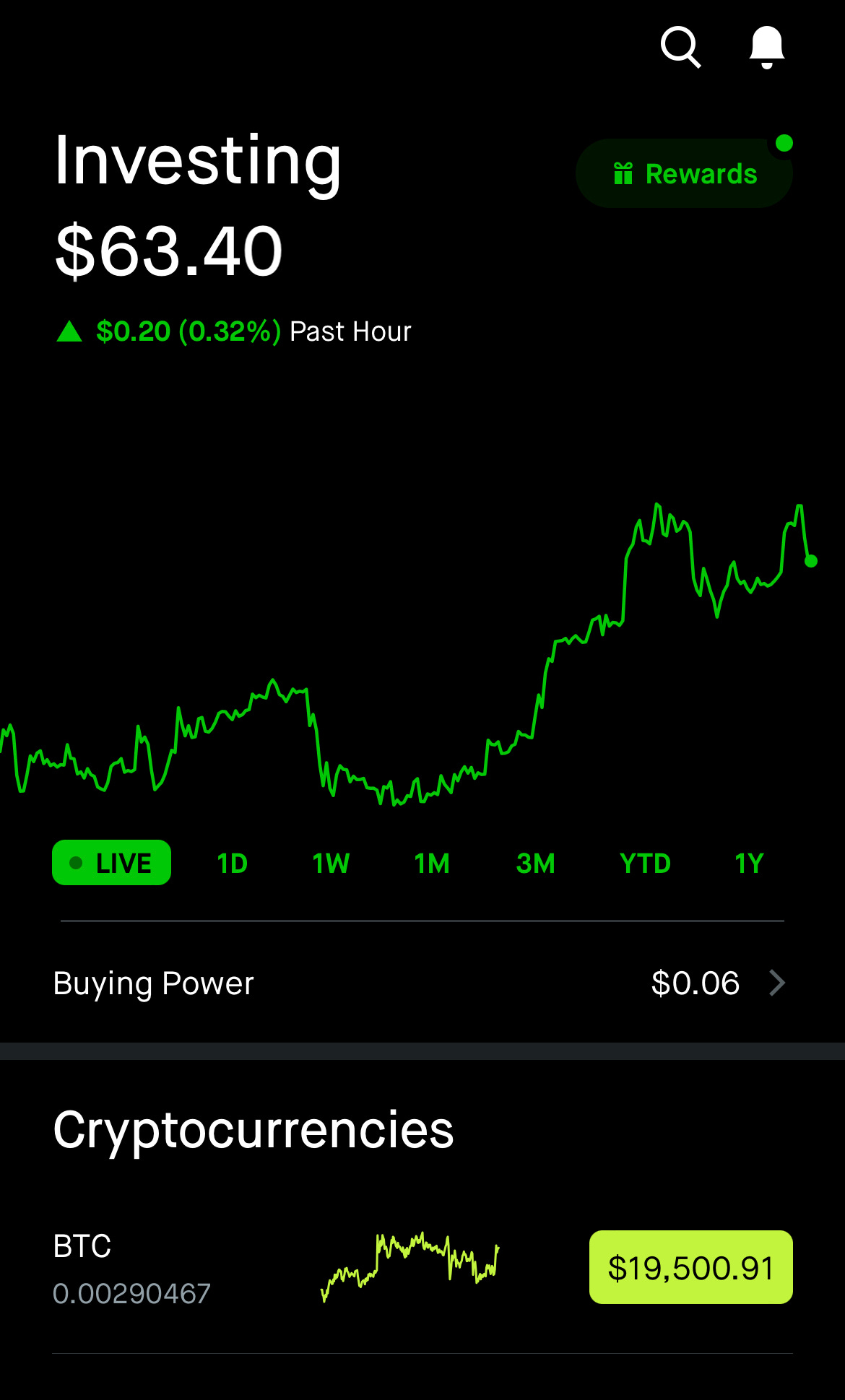

Historically, I’ve purchased my index funds through Vanguard and Fidelity, but when I bought my Bitcoin, I decided to use Robinhood. Using Robinhood has by-far been the best experience when it comes to buying, selling and tracking financial investments.

My favorite feature is the real time graph of the value of your holdings with Robinhood. I may or may not check it several times throughout the day.

Bitcoin is traded 24-hours-a-day, 7-days-a-week, so it’s fun to check my Bitcoin holdings on a Sunday afternoon to see that my Bitcoin gained 20 cents in value in the past hour.

The joy doesn’t come from the value gained (though that is nice), it’s getting to see the investment I own being traded in real time. It makes me feel like a kid again.

Let’s see where this goes. I’ll report back next week.

If you enjoyed this piece, hit that like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

I have 0.00014358 shares of Bitcoin, so you are much more invested in it than me! :P

Great stuff - looking forward to seeing how this plays out.