Staying the course and doubling down

As chatter about an economic recession continues, I'm playing the long game with my portfolio.

Saving enough money for retirement is hard.

After taking a look at my entire investment portfolio a couple weeks ago, I was curious and decided to look for an online calculator to predict how much money I’ll have in retirement at my current level of investment.

I felt confident as I clicked on the link for NerdWallet’s Retirement Calculator. I’ve been investing with index funds since getting my first job out of college, and over the last 18 months, I’ve been diverting the equivalent of between 10 to 15% of my income toward retirement.

I should be set for retirement, right? Unfortunately not.

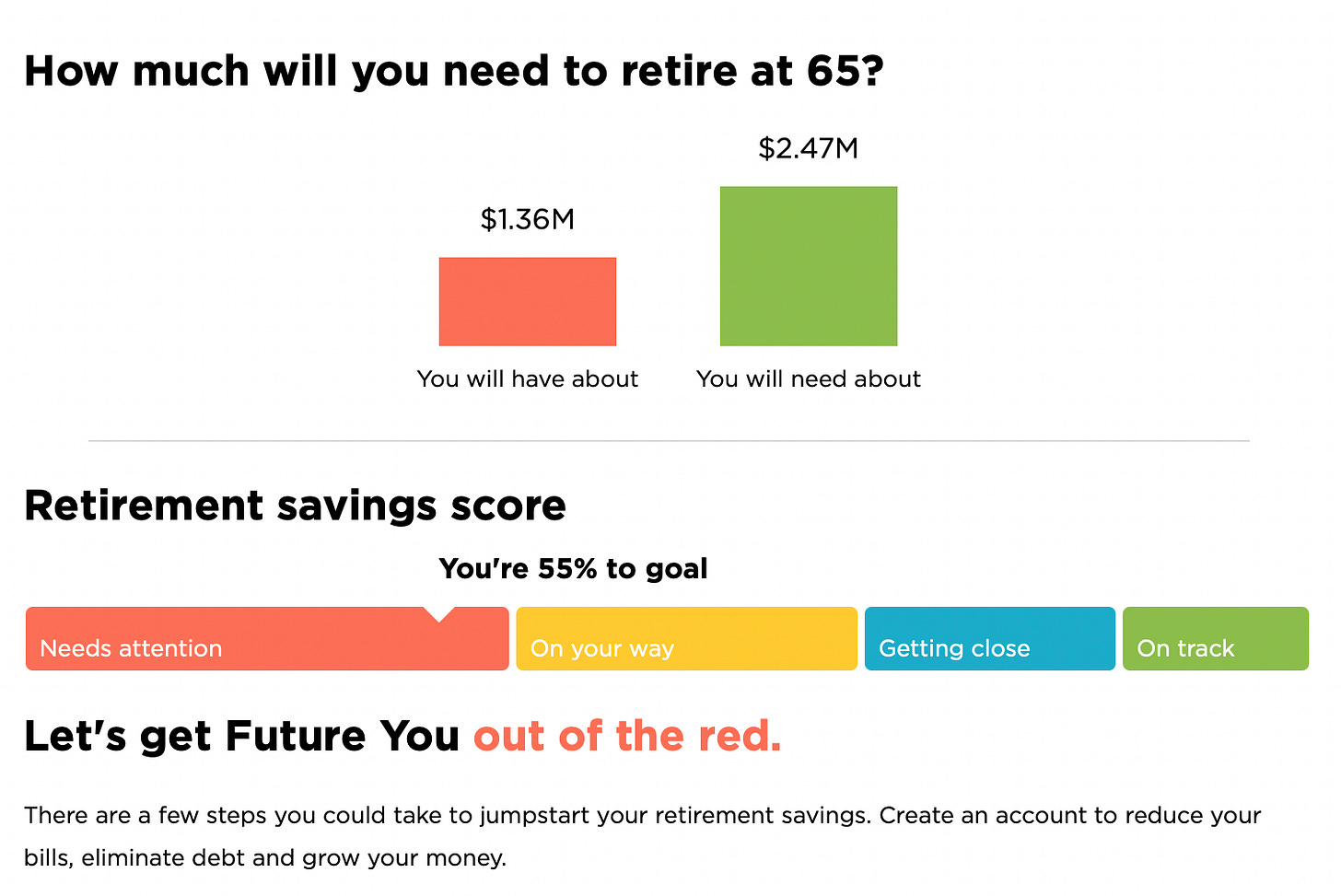

With my current level of investment, assuming 6% returns over the next 40 years, I can expect to have $1,650 to spend per month after 65 (a $1.36M Nest Egg). That’s lower than my current standard of living.

And when I input that I’d like to have $3,000 per month to spend in retirement after 65 (a $2.47M Nest Egg), NerdWallet told me that my retirement savings “needs attention.” Yikes.

The numbers from NerdWallet don’t include income from social security (if it still exists when I’m 65), income from part-time work, or money from a future-spouse’s nest egg.

Still, I’m glad I have this newsletter to keep me accountable and keep my investments on track.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month.

In addition to exploring the stock market investing of my company-sponsored plan, I plan to diversify my portfolio by investing an additional $50 per month in different types of investments like cryptocurrency, commodities, potentially buying shares of real estate and more.

But first, let’s take another look at my current portfolio.

TL/DR Take Aways

Top Line:

Every investor needs to have a goal that he or she is trying to achieve through investing. And every investor needs to have a plan to accomplish those goals.

Investment calculators, like the one from NerdWallet, can give you a good idea about whether your current investment strategy will allow you to reach your financial goals.

Bottom Line:

Coming into this post, I already was planning to increase my investing by $50 per month. Now, after seeing that this increase isn’t going to be enough to get me to my financial goals, I need to take another look at my budget to see if I can find the money to invest even more.

Taking a look at the performance of my portfolio

The Securities and Exchange Commission, which oversees and regulates the sale and exchange of financial assets in the United States, requires companies that manage mutual funds to share information about their funds with those invested in the funds.

To put it a bit more simply, the U.S. government requires financial services companies to provide information about the investment products they’re offering to investors.

This is great because it allows savvy investors, like you and I, to look at what is within an investment product, whether that product has gained or lost value in the past, and who is managing the product.

So when I wanted to look at the performance of the index funds I own earlier this week, I just typed the name of the funds I owned into a search engine and several results on the performance of my funds came up instantly.

Here’s a quick overview of what I found.

Vanguard International Dividend Appreciation Index Fund Admiral Shares

This index fund has been crushed over the past year, and is down more than 12%. At the same time, the fund was created to experience the highs and (currently) the lows of the international stock market. It has risen in value by more than 5% in the past five years. Additionally, the companies within the fund pay dividends that are then reinvested to increase the value of the fund. Pretty neat.

Vanguard Mid-Cap Growth Index Fund Admiral Shares

This index fund has also been crushed over the past year, and is down more than 18%. Similarly, this fund was created to experience the highs and (currently) the lows of the U.S. stock market. It has risen in value by more than 11% in the past five years.

Fidelity 500 Index Fund

This index fund has taken less of a beating over the past year, and is down less than 5%. This fund is meant to more-or-less mirror the performance of the U.S. stock market. And while I haven’t been invested for the whole period, the fund boasts fund growth of more than 12% growth in the last five years.

Invesco International Small-Mid Company Fund Class R6 (Invested with Fidelity)

This index fund of international stocks has also seen huge losses over the past year, and is down more than 36%. This fund is meant to include international stocks with potential for growth. And while, I haven’t been invested for the entire time, the fund has lost more than 13% in the last five years. The silver lining is that since the fund’s inception in 2011, its value has increased by more than 120%.

Every single one of the index funds I’ve bought into has lost money in the last year. As much as 36% of the price with my Invesco fund.

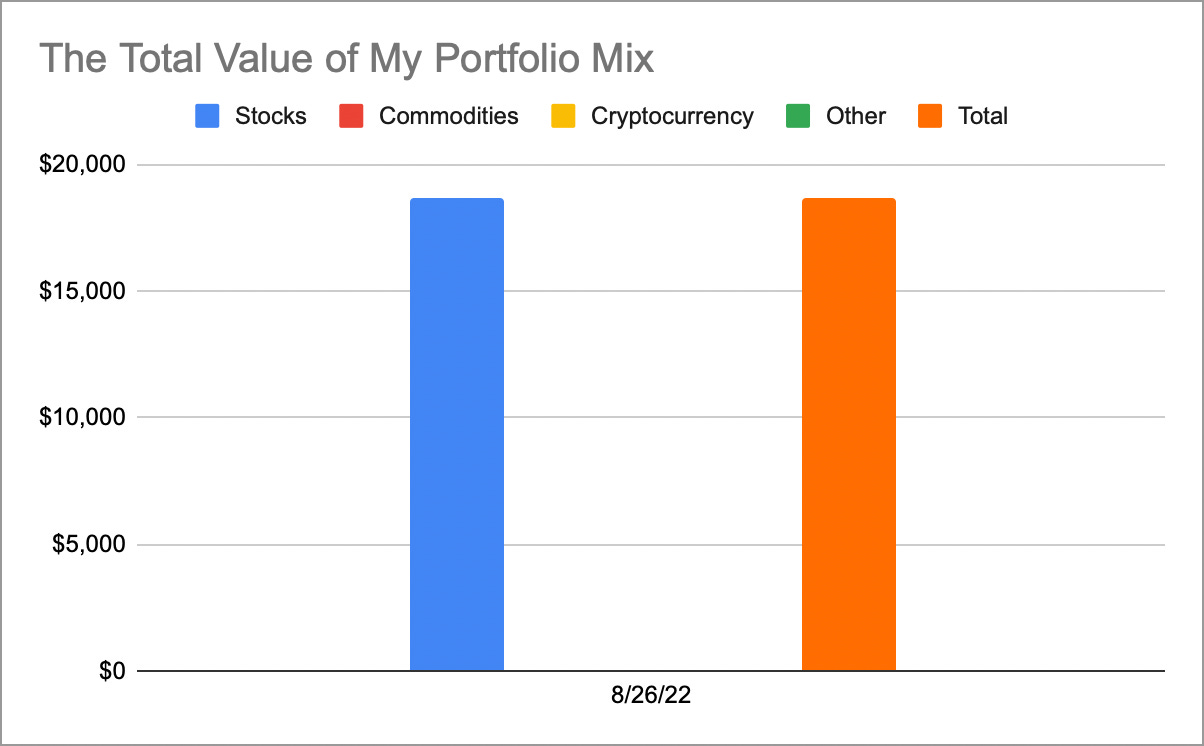

The U.S. and international stock markets have been rough lately. And with my present portfolio, all my investments are in the stock market, so I have nowhere to hide.

And while I’ve been tempted to do something rash as I watch the price of the funds I’ve bought into continue to decrease even as I’ve continued to invest in them, I know that I need to stay the course.

As someone who isn’t 30 yet, the investment in the stock market was purposeful.

I’m accepting the risk that my portfolio is going to experience little growth, or even lose money, as the stock market declines because I know that when the stock market begins experiencing sustained growth again, the value of my portfolio will experience explosive growth.

So now that I know how my current investments are doing, I need to decide what I’m going to do next.

Every investor needs a goal, and a plan to reach it

When I blow out the candles on top of the birthday cake brought out for the family celebration of my 65th birthday, I want to have $2.5 million saved in retirement funds.

With my portfolio hovering at just under $20,000, I have a long way to go.

As I’ve discussed my investment portfolio with several financially-savvy friends, one of whom who used to be a financial advisor, I discovered that when it comes to investing, it’s important for me to know my financial goals. Once, I know where I want to go, then I can figure out the investing strategy to get there.

So I settled on the target of amassing a portfolio of $2.5 million by my 65th birthday.

Great — now how do I reach that goal?

This is the question I’ve wrestled with for the past two weeks. How do I multiply the value of my portfolio by 125 times in 37 years? Especially when I know that my current level of investing won’t get me to my goal.

I toyed with buying into individual stocks, which, when picked properly, can net incredible returns. For example, someone who invested $1,000 in Tesla in 2010, would earn $147,400 if they sold their stock last year.

Then, I figured this would be a poor idea at my current experience level with investing because buying into a stock that is priced low, but has a high potential for growth, is much riskier than buying index funds of stocks.

And with my current portfolio already being high risk, I just couldn’t see the benefit in upping the ante right now.

Then, thinking back to my experience with the NerdWallet’s Retirement Calculator, I had an idea for how to increase my investment returns over the next several decades. Begin investing more money every month.

I know, mind-blowing.

And there are two ways I can increase the amount of money I invest: Make more money, or shift around my budget to allow me to invest more.

Coming into this post, I already was planning to increase my investing by $50 per month. Now, after seeing that this increase isn’t going to be enough, I need to take another look at my budget.

I’ll report back next week. (And I know, sorry for missing my post last Monday).

💬 Comment below with your investing goals

⏱ Flashback: Do you know the make-up of your current investment portfolio and how much it’s worth?

📨 Connect with me on Twitter @EvanJamesCarter

It'd be interesting to see how you came to the $50 a month number...and how is this effecting your overall budget? Why $50 as opposed to something else (is this the 10-15% of your income)? I guess you're taking this one step at a time so things are evolving slowly - and it sounds like you may be trying to adjust this number.

Are your investing goals conflicting/impacting other financial goals you may have (i.e., paying off student loans, saving for a home, purchasing an engagement ring in the future, etc.,)? I'm also curious to hear what your "retirement philosophy" is? Some people don't believe in retirement (that's NOT an excuse to not save, but rather a view that they will be working until the day they die).

My grandpa, for example, is still working. Why? Because he believes that we're designed to work and once you stop working then your brain goes to mush. That's why, at 90 years old, he refuses to hire a company to shovel his condo's driveway because why not do it himself? Dennis Prager is another person who doesn't "believe" in "retirement". Again, just curious what you mean by "retirement". The more I think about it, the more I realize that it's "just something you do" before forming true conviction about it.