The power of brown bagging it.

Remember compound interest? The dollars and cents really do add up over time.

There’s a lot of cynicism surrounding penny-pinching as a way to build wealth. And on one hand the reason is understandable. The money someone will save from spending less of their income in a month than they have in months previous won’t make them rich.

That person’s income hasn’t changed. And so the suggestion that just spending less will allow someone to create more wealth for themselves leads to mocking statements like this tweet.

The tweet isn’t wrong. But it’s extremely short-sighted.

There are times when the only way to meet certain economic goals is for a person to increase his or her income. Someone making $60K a year is not going to be able to afford the monthly mortgage payment on a $450,000 house, even if they lived exclusively on peanut butter and jelly sandwiches.

That person just doesn’t have enough cash coming in every month to afford the payment. Regardless of how much money is saved. Point taken.

But rejecting the power of penny pinching just because it doesn’t solve every financial goal is throwing the baby out with the bathwater. And the baby was holding a winning lottery ticket.

Shame. I think that with a little bit of love and a lot of work, baby would have grown up to be an incredible human and the lottery winnings would have been nice as well.

Spending less than I earn is the foundation of financial freedom. And then taking some of the money I saved and putting it to work through investing is the first step toward wealth creation.

If I look at it that way, making my morning coffee at home and bringing my lunch to work is really a small sacrifice of my time.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in cryptocurrency, index funds, stocks and more.

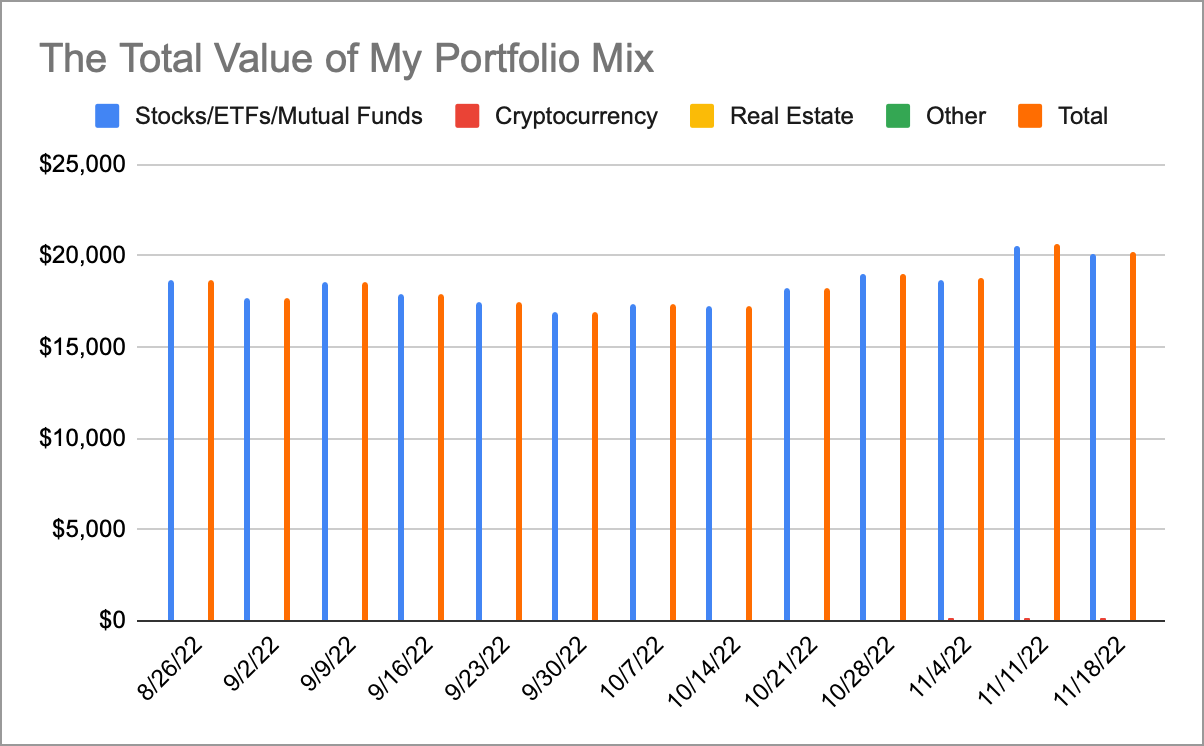

Before discussing how I control my spending on non-essential items month-to-month, let’s take a quick look at how my portfolio has been performing.

My Portfolio Holdings as of 11/18/22

Apple stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

My portfolio lost money again last week. Not a lot of money, but it’s not growing. My stocks aren’t really doing anything and my Bitcoin still hasn’t recovered following the collapse of FTX.

The economic outlook for the near future isn’t very good. I say this every week, and I’ll say it again. I’m in this for the longterm, and I’m going to continue to invest.

And controlling my discretionary spending — the non-essential spending I have control over — is one way I can continue investing.

First a note: If you’re reading this and you have debt (that isn’t a mortgage), you may want to look at paying that off before spending more money on investing.

If you don’t have personal debt, then I want to share the power of simply investing the savings of brown bagging it to work and making my coffee at home in the morning.

In a typical month, I’m able to keep the money I spend on coffee, carry-out and eating at restaurants to about $100. This number is appropriate for my lifestyle and level of income, but may be different for you.

For me, staying within my food budget allows me to have money to make recurring monthly investments on my Robinhood app in Apple stock, Bitcoin and Vanguard High Dividend Yield ETF. Over time, a return from the Apple stock and the Vanguard ETF are basically guaranteed. And in time, I think I have a pretty good chance of seeing a return on my Bitcoin as well.

One practical way I’m able to stay within my food budget is by avoiding buying coffee from coffee shops. Instead, I make it at home.

I buy my coffee from a local small-batch roasting company at the cost of $12.40 for a 12 ounce bag. I actually get a discount because I’ve signed up to get a new bag of coffee every two weeks.

I’m biased because the roasting company was started by my two best friends, but I’m also a coffee snob. The coffee is good and is competitively priced. If you live in the Detroit metro area, you should check them out.

Anyhow, the grounds typically last me for two weeks, and I typically get two cups of coffee every time I brew, leading to a cup of coffee roughly costing me 45 cents a cup.

McDonalds doesn’t sell coffee for a dollar anymore. And lately, even gas station coffee costs me about $1.50. Often times, the coffee is $2 or $3 dollars. I drink coffee every morning, religiously.

So that $1.50 to $2.50 I’m saving per day by making my coffee at home adds up really quickly.

Everything in moderation.

I have a high value for spending money to go to a coffee shop with a friend to connect. I just don’t want to spend any more than I have to on my caffeine addiction.

The money I spend on Tim Hortons coffee is spent. Never to be seen again, while on the other hand, any money I saved and invested in the markets is basically guaranteed to earn me a return of 6 percent in the stock market. For me, the choice is obvious.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

💰 I help people finance homes for a living. If you’re looking to buy or refinance, use my link to get a sweet mortgage discount from Rocket Mortgage.

📈 Inspired to begin investing yourself? Use my link to open an account on Robinhood, and we’ll both get between $5 and $200 toward a free stock.

This is one of my favorite postings yet! I love the subject of small cost savings (management of resources) for the vision of long-term impact. And of course I liked the promotion of our coffee biz 😁

Great stuff, Evan!