Until next time: This is my last post on Evan Invests.

Things in my life are shifting, and unfortunately, that means posting needs to be shelved. At least for the time being.

When I began Evan Invests ten months ago, I had some time on my hands, and I was looking for a hobby. Ten months later, I’ve found a hobby, but have less time on my hands.

The focus on finance this newsletter allows has led to the growth of my wealth. But it hasn’t given me more time. My priorities are shifting in anticipation of growth in several areas of my life.

And in order for new things to have the space to grow, sometimes old things need to be let go.

As I’m writing this post, I’m reminded of an 18-month period of my life where I would attend the practices of a professional pianist once a week. Meeting in the most serendipitous way possible, I had initially been invited to attend practices after meeting the pianist at the chiropractor’s office.

My relationship with the pianist continues to this day, but after starting my job at Rocket Mortgage two-and-a-half years ago, attending weekly piano practices no longer worked with my schedule.

Even if that meant I would no longer hear, what he claimed is, the proper interpretation of Dubussy’s “Clair De Lune” at the end of Thursday night practices.

So to put a nice bow on the 29-post arc of this newsletter, I would like to share the biggest financial lessons I learned along the way.

I need to have a clear picture of my finances. How much money I have. How much money I make per month. How much money I anticipate needing to spend in a month. How are my investments doing. If I don’t keep track of my finances, I’ll never be able to grow them.

I need to have a vision for my money. A budget was essential for me being able to do this. The budget not only provided guardrails to make sure I didn’t spend more money than I made, but also guided my giving, investing, and saving. I save in a specific way because I’m intentionally planning for home ownership.

I need to ignore the daily news and make investments that I’m comfortable with because I believe it will grow over years. Then once I find an investment I believe in, I need to continue investing through the ups and downs of the market (with some limits). I’m fully on the dollar cost-averaging train. Economists haven’t been able to agree upon when the next recession will come for the last 10 months. I can’t stop investing while I wait for everyone to sort it out.

I need my money to work for me. I work hard to earn my money, and as I’ve learned more about finances writing this newsletter, I’ve learned that my money can work for me. No longer will I accept savings account interest rates of 0.03 percent, when I can earn 4.21 percent at another bank, or earn 5.5 percent by buying one month treasury bonds.

I can’t save my way to prosperity. I’m very good at saving, and as I’ve been reading up on finance to write this newsletter, I’ve become a more educated investor and more savvy manager of my personal finances. But in addition to giving me a better understanding of how to make money, it’s also driven me to take my 9-to-5 career more seriously and look for ways to earn money outside my career.

Hope is essential. There is a depressing sub-genre of creators on social media, who are obsessed with talking about the terrible financial condition that many Millennials and Gen Z find themselves in. And the statistics are very bad. And the cost of housing is on average nearly four times higher than it was for my parents generation. But wallowing about it doesn’t help me. I’ve measurably increased my wealth over these past 10 months because I decided to educate myself and be proactive. There are still plenty of opportunities out there. And compound interest is still compounding.

I’m going to miss writing this newsletter.

As a former journalist, learning about new things and then getting to write about the things I just learned about is one of my passions.

This post isn’t goodbye forever — I may post on this newsletter again if I have some time and learn something new that I deem worth sharing — but it is goodbye for now.

Think Casey Neistat at the end of his daily vlog.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I look to grow my wealth through wise money management and making investments in cryptocurrency, index funds, stocks and more.

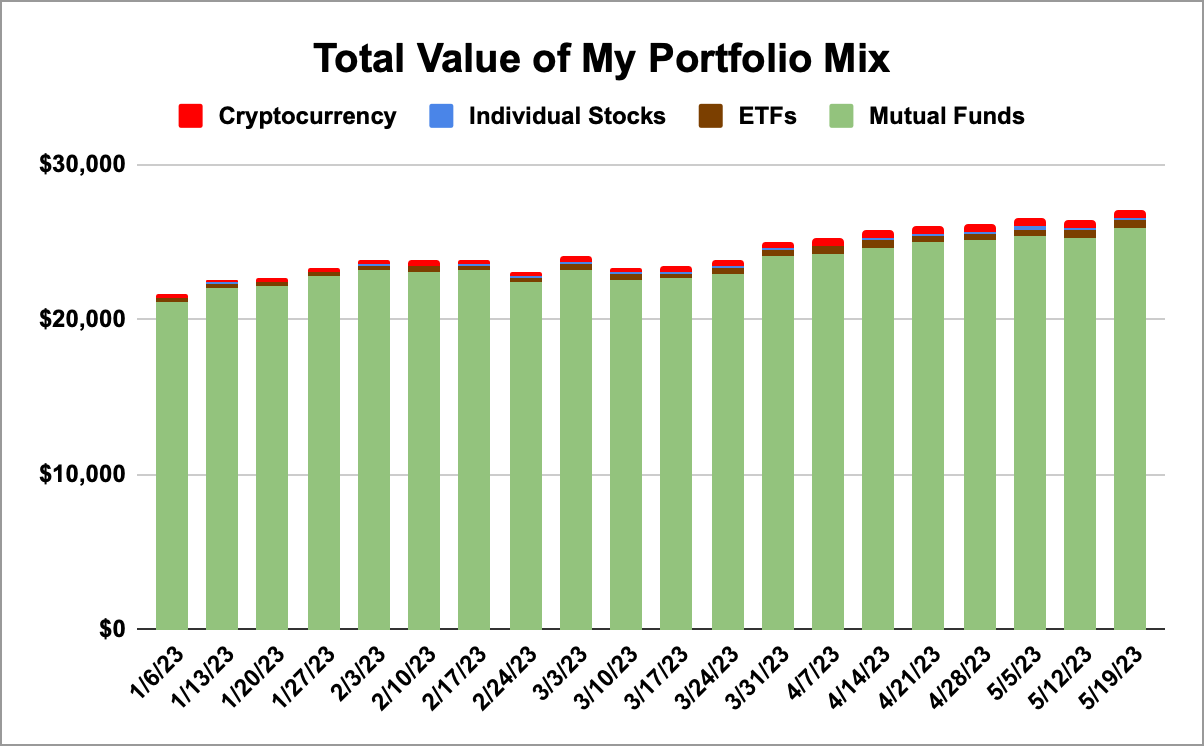

Let’s take a quick look at how my portfolio has been performing in the past week.

YTD Invested (Total): $2,685.77

YTD Returns (Total): $5,501.79

YTD Portfolio Growth: 13.0 percent

→ YTD S&P 500 Growth: 9.6 percent

→ YTD BTC Growth: 61.8 percent

My Portfolio Holdings as of 5/19/23

Apple stock

HF Sinclair stock

Rocket Companies stock

Steelcase stock

Verizon stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

SPDR Portfolio S&P 500 Growth EFT

iShares S&P SmallCap 600 ETF

Vanguard FTSE Emerging Markets Fund

Invesco S&P 500 Momentum ETF

Vanguard FTSE Developed Markets ETF

Invesco S&P 500 Quality ETF

iShares Core S&P 500 ETF

Vanguard Total Bond Market ETF

Until next time, friends.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

📨 Connect with me on Instagram @Evan.Invests

🚀 My favorite financial tweet from the past week.

💰 I help people finance homes for a living. If you’re looking to buy or refinance, use my link to get a sweet mortgage discount from Rocket Mortgage.

📈 Inspired to begin investing yourself? Use my link to open an account on Robinhood, and we’ll both get between $5 and $200 toward a stock.

Thanks for sharing your learning process in this journey, Evan!