If my wealth isn't growing, it's shrinking.

Part 1 | Notes from my read-through of The Single Best Investment by Lowell Miller.

Since the beginning of my investment journey, the majority of my assets have either been stocks, or consisted of several stocks in an index fund.

I did this because I believed that the value of stocks are something that grow over time, so my wealth will grow over time as my investments grow.

This is, in fact, true. Over time as my stocks go up in value, my wealth will increase.

But before reading The Single Best Investment by Lowell Miller, I didn’t consider the role that inflation plays in how my wealth grows over time.

Right now in the United States we’re coming off some of the highest inflation that the country has faced in 40 years. In January, the inflation rate was estimated to be at 6.4 percent.

But even when inflation isn’t in the headlines, it’s still slowly eating away at the value of the dollar. From the end of World War II to the early 2000s, inflation went up on average 4.10 percent per year.

What that means in simple terms is this: When I’m thinking about growing my wealth through investing, I’m not just trying to grow my wealth above the original amount I invested (the principle). I’m actually looking to grow my wealth above the rate of inflation.

That’s why I’m so interested in the rate of return of my various investments. It’s about wealth preservation and wealth creation.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I look to grow my wealth through wise money management and making investments in cryptocurrency, index funds, stocks and more.

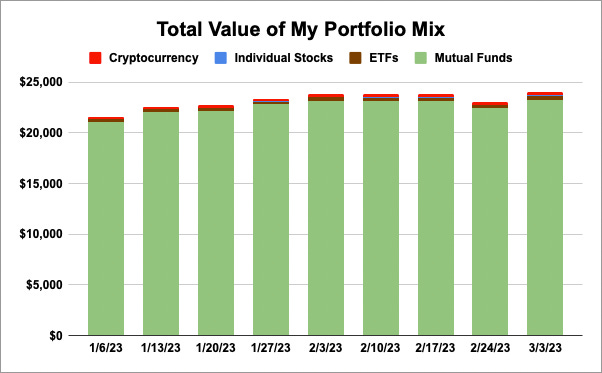

Let’s take a quick look at how my portfolio has been performing in the past week.

My Portfolio Holdings as of 3/3/23

Apple stock

Rocket Companies stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

The assets in my portfolio were stagnant again last week, with my Bitcoin loosing a small amount of its value and my stock-based assets all slightly gaining value in price.

To be completely honest, watching my investment portfolio over the past couple of moneys has been a bit boring and deflating as it seems that the market isn’t moving decisively in one direction or another.

But this is exactly why I practice dollar cost average investing. To take the emotion out of my investing and make sure I’m continuing to buy, knowing that over time, the stock market always goes up.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

💰 I help people finance homes for a living. If you’re looking to buy or refinance, use my link to get a sweet mortgage discount from Rocket Mortgage.

📈 Inspired to begin investing yourself? Use my link to open an account on Robinhood, and we’ll both get between $5 and $200 toward a stock.