Making cash work: Getting the best interest rate for my savings dollar.

Rising interest rates may be a blessing in disguise for the rate of return I can earn with my savings account.

The inflation rate in the United States has never been as high as it is today in my lifetime. With the price of goods this year set to increase more than 8 percent above last year’s prices, inflation is higher than it has been since 1981: the tail end of a period dubbed “The Great Inflation” by economists.

Inflation sucks. Thankfully, in every challenge there is an opportunity for growth.

During the Great Inflation, a period from 1965 to 1982, the United State’s inflation rate skyrocketed from less than 2 percent in 1965 to as high as 13.3 percent in 1979.

In the midst of rapid inflation, the stock market experienced little growth in price. One silver lining for investors during this period was that banks offered high interest rates for Certificates of Deposit.

When someone lent a chunk of money to their bank for a predetermined period of time — a Certificate of Deposit — the bank paid between 4.0 percent and as high as 18.7 percent during the period for a 3-month term.

While high inflation eroded much of what was gained through high interest rates on the CDs, the savings vehicle provided a safe place for investors to grow their money during this rocky economic period.

One of the people who took advantage of the high interest rates offered on CDs in the 1970s was my grandfather.

Similarly to how I discussed investing a portion of money into cryptocurrency and stocks every month in last week’s post, my grandfather consistently purchased CDs. And when the term of a CD came to an end, he could spend it if he needed the cash, or reinvest the money, along with the interest he had earned, into another CD.

My grandfather was taking advantage of the power of compound interest to grow his wealth — something I directly benefited from when he paid for a portion of my college education.

While 2022 isn’t 1980, the interest rates on short-term CDs has risen back to 4 percent in some cases. High yield savings accounts aren’t too far behind.

In the midst of high inflation, growth in my savings account is a must.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in cryptocurrency, index funds, stocks and more.

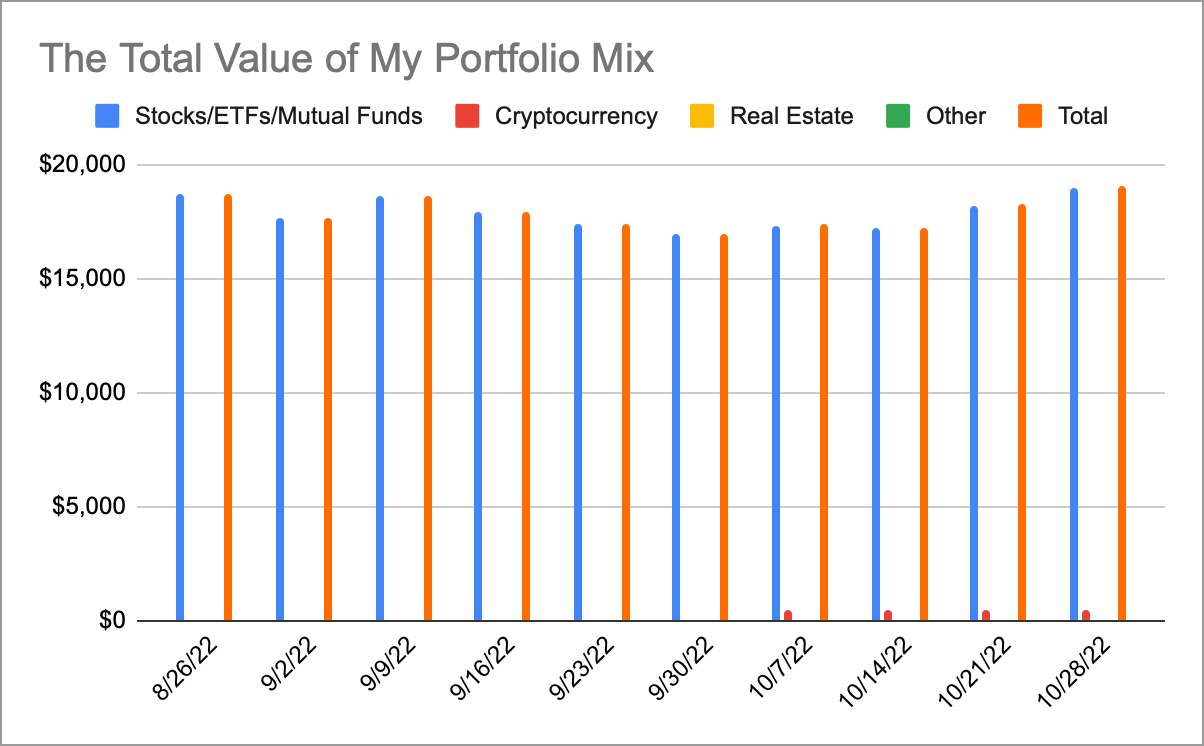

Before discussing CDs and high yield savings accounts, let’s take a quick look at how my portfolio has been performing.

My Portfolio Holdings as of 10/28/22

Apple stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

The stock market and Bitcoin did well last week, and the overall price of my portfolio rose to its highest level since I began tracking things at the beginning of this journey two months ago.

Again, I’m not overjoyed with the growth. The collective price of my portfolio holdings may be up, but I’m still loosing money, as my portfolio is just treading water even as I’ve invested more than $1,000 into it between my employer-backed plan and individual investments.

Oh well. I’m in this for the long game, so short term losses aren’t phasing me.

Even if the market was experiencing record growth right now, I would still want to keep reserve cash in my savings account.

First because I need to the cash for the eventual downpayment on a house. And second, because financial experts I trust like Dave Ramsey and Graham Stephan advise that people have enough cash to pay for three to six months of expenses should a life emergency occur.

And as our friends at the Federal Reserve keep raising rates, the interest rates on CDs and high yield savings accounts are expected to continue rising. Sweet!

In the past month, financial services institutions offered clients interest rates as high as 4 percent on a CD with a one year term according to NerdWallet.

High yield savings accounts are also becoming competitive, with NerdWallet compiling a list of financial institutions offering clients interest rates of as high as 3.12 percent over the course of a year.

And sometimes getting a better interest rate is as simple as asking. A couple weeks ago, I spoke with a banker at my financial institution, PNC, and they increased my savings account interest rate from 0.01 percent to 0.03 percent simply because I get a certain amount of money in direct deposits from my employer every month.

What are you doing to put your savings to work?

I know that I’m going to do something with my savings account soon. And if interest rates continue to rise, I may take a page out of my grandfather’s investing strategy and buy a CD.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

Where can you purchase a CD? Does Robinhood facilitate those kinds of investments?