Taking My Bitcoin Offline

Even as the price of Bitcoin recovers after the collapse of FTX, I want to play it smart.

Following the collapse of the cryptocurrency exchange FTX last November, the price of Bitcoin plummeted by more than 20 percent, and I decided to take my BTC off of Robinhood where I was holding it. For the time, I stashed it in Coinbase wallet, a digit cryptocurrency wallet.

Even with the price of Bitcoin returning to more than $22,000, a level greater than before it crashed in November, I still don’t want to forget the difficult lessons learned when investors lost billions in cryptocurrency holdings when FTX folded.

In November I began a mission to take full control of my Bitcoin by taking the private keys that prove I own my Bitcoin, and taking them off of a digital device that could be tampered with over the internet and placing them on a device not connected to the internet.

And now I’ve done it. All my Bitcoin is now stored on my Trezor “cold wallet,” disconnected from the internet.

My Bitcoin wallet will never be hacked (unless a hacker was able to get to me in the short periods I connect my wallet to my computer). And even if every cryptocurrency exchange in the world collapsed, I wouldn’t lose my Bitcoin. Though the Bitcoin I did have would lose all its value.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in cryptocurrency, index funds, stocks and more.

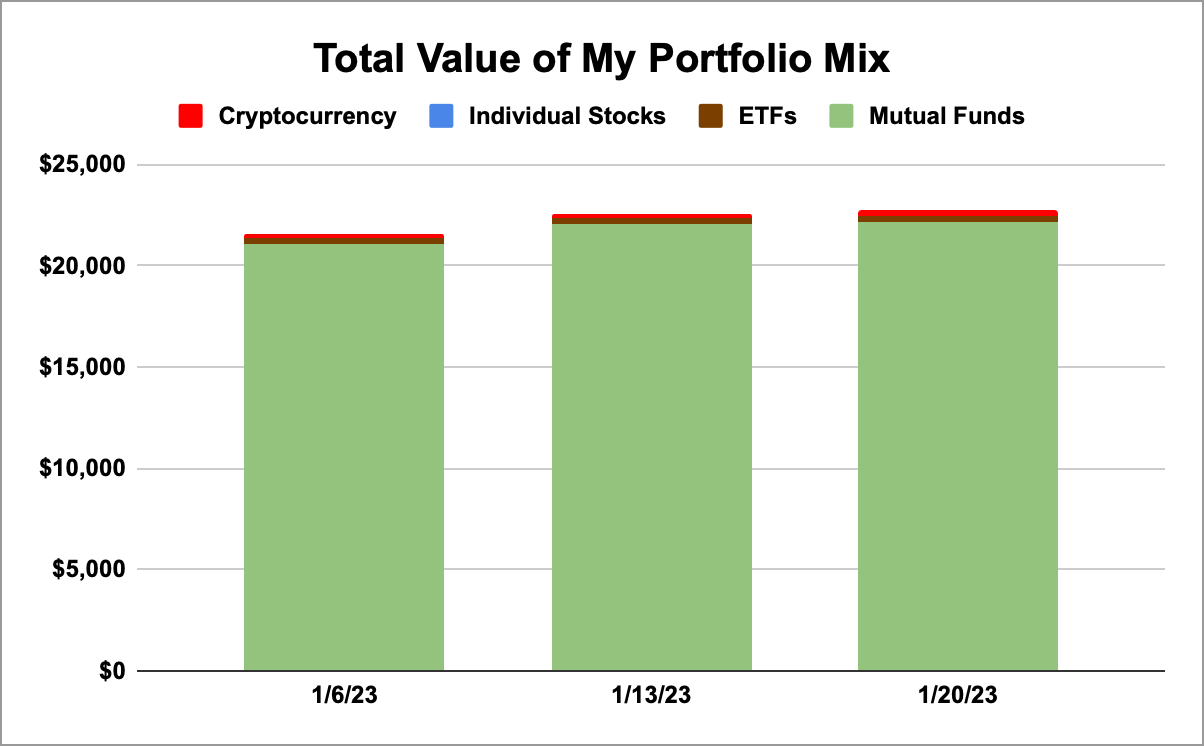

Before continuing to talk about how I’m securing my Bitcoin, let’s take a quick look at how my portfolio has been performing.

My Portfolio Holdings as of 1/20/23

Apple stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

Honestly, my portfolio hasn’t moved a whole ton since last week. The price of Bitcoin continues to climb, but JP Morgan Chase just encouraged investors to sell and take the profits on their investments. Yikes.

I’m not going to follow that advice because I’m looking to build wealth for the future, so I have time to take short term losses. Honestly, if the market takes another tumble, it just means I get to buy the investments I’m already buying at a discount.

Back to cryptocurrency wallets.

The cryptocurrency “cold wallet” I’m using to store my Bitcoin offline is made by Trezor and cost $69. Several other cold, or hardware, wallets can be found using a simple search on Google.

My Trezor wallet was very simple to set up, and within an hour of opening the box it came in and plugging the device up to my computer, I had successfully set up the device, and transferred all of my Bitcoin to it. Even for someone who isn’t super computer-savvy, it’s a relatively simple process.

So is it likely that another cryptocurrency exchange becomes insolvent? And on top of that, that the cryptocurrency exchange which fails is the one where you’re holding your Bitcoin? I have no idea.

But unfortunately, with something as new as Bitcoin and other cryptocurrencies, the failure of exchanges where cryptocurrency is bought and sold is more common than I would like it to be.

So for the price of $69 and less than an hour of setup, I think it’s worth it to take control of my Bitcoin.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

💰 I help people finance homes for a living. If you’re looking to buy or refinance, use my linkto get a sweet mortgage discount from Rocket Mortgage.

📈 Inspired to begin investing yourself? Use my link to open an account on Robinhood, and we’ll both get between $5 and $200 toward a stock.