I finally did it: Putting my savings to work!

The average annual interest rate for a savings account in American is 0.23 percent. Now I'm earning 4.21 percent in a year.

One of the first things I learned as I began exploring investing is that wealth isn’t built wealth through saving money alone. In order to build wealth, I need to invest money into assets that grow.

That’s why I’ve spent most of the posts in this newsletter talking about investments that are comprised of stocks (partial ownership of a company) or Bitcoin. They grow consistently over time.

Still, saving money is a necessary part of financial stewardship. And a savings account is often the best place to stash cash needed for everyday expenses, emergencies, or short-term savings goals.

While last months 6.5 percent rate of inflation means that money in the bank is actually losing buying-power, investing the money I need to pay my bills later in the month would be incredibly foolish.

This challenge is brought to an even finer point with the dollars I have stashed away to make the down payment on a home.

Thankfully, there are ways to put my savings dollar to work.

As I discussed in my post a few months back — Making cash work: Getting the best interest rate for my savings dollar — there are several risk free savings products that I can use to increase the amount of money that I’m earning with my money (interest).

And while I wasn’t able to find anything matching December’s 6.5 percent rate of inflation, I was able to improve upon my annual savings account interest rate of 0.03 percent.

In this newsletter, Evan Invests, I explore the world of investing from the perspective of the everyday investor by making small investments every month. Follow along with me as I invest in cryptocurrency, index funds, stocks and more.

But before continuing to talk about how I’m maximizing the interest rates on my savings account, let’s take a quick look at how my portfolio has been performing.

My Portfolio Holdings as of 1/27/23

Apple stock

Rocket Companies stock

Bitcoin

Fidelity 500 Index Fund

Invesco International Small-Mid Company Fund Class R6

Vanguard High Dividend Yield ETF

Vanguard International Dividend Appreciation Index Fund Admiral Shares

Vanguard Mid-Cap Growth Index Fund Admiral Shares

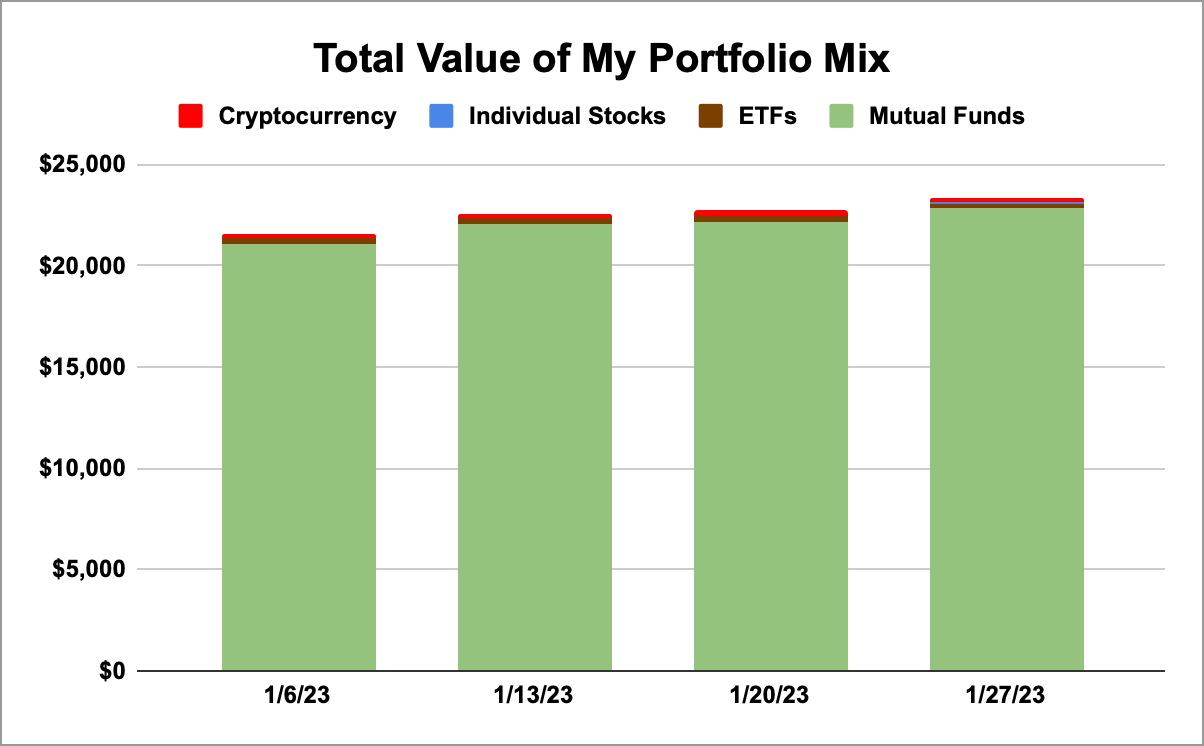

My portfolio didn’t do a whole ton last week. The value of my mutual funds, ETFs, individual stocks and Bitcoin barely moved.

There’s a lot of conflicting information coming out in financial media right now — including from my favorite financial creator Graham’s Newsletter — about whether or not the market is headed for a downturn, and the economy is headed for a recession.

I don’t have a crystal ball, but I’m sticking dollar cost average investing whether the market dips or rallies for big gains.

OK — let’s get back to supercharging my savings account interest rate.

I finally did it. I opened up a high yield savings account that advertises a 4.21 percent annual rate of return. Up from the 0.03 percent I was earning, this is a huge win.

Based off Nerdwallet’s list of best savings accounts for January 2023, I opened an account with UFB Direct. And if you have more than a few thousand dollars set aside for either an emergency fund or for short term savings, I would encourage you to take a look at the list as well.

Even an average annual interest rate of 3.30 percent is better than the average rate of 0.23 percent that most Americans are earning.

And while I decided against this approach, locking savings away for a year in a CD may make sense for some readers. If you can afford to set aside the money for a year, you can get a better interest rate than what high yield savings accounts offer.

I’ll report back next week.

If you enjoyed this post, hit the like button and leave a comment. Thank you!

📨 Connect with me on Twitter @EvanInvests

🚀 My favorite financial tweet from the past week.

💰 I help people finance homes for a living. If you’re looking to buy or refinance, use my link to get a sweet mortgage discount from Rocket Mortgage.

📈 Inspired to begin investing yourself? Use my link to open an account on Robinhood, and we’ll both get between $5 and $200 toward a stock.

I've been considering this, but just haven't given it enough thought to take action on it. Your experience with it is helping me get past the friction of opening an account with a bank I'm not familiar with, so I think it's time to finally take the leap! Thanks, Evan.